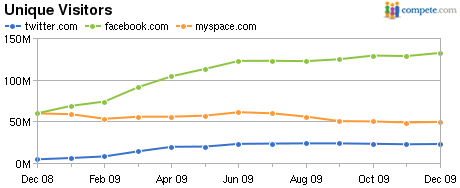

A majority vote social media as important – critical for banking

Earlier this year we surveyed the Financial Services Club members and readers of the Finanser for their views on social networking and social media in banking. In February, we published the initial results as a qualitative report and now we have crunched the numbers to produce the quantitative report. There were 444 respondents to the…