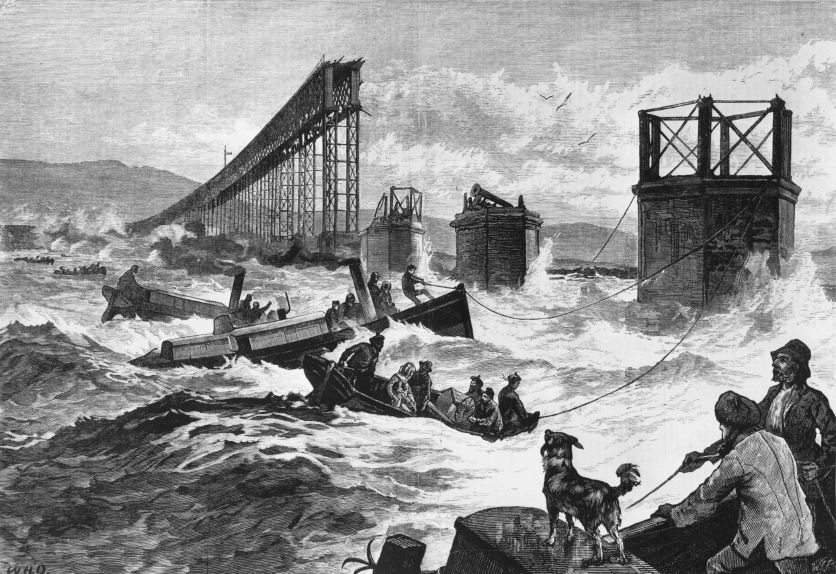

APIs is all about trains, ships and standards

We had a meeting of the Financial Services Club in Oslo last night, talking about the Payment Services Directive 2 (PSD2) and Open APIs (Application Program Interfaces). It was a fun meeting and covered the in’s and out’s of closed versus open APIs, the implications of allowing Trusted Third Parties (TTPs) access to the bank’s…