Regulation

The White House, Donald Trump, Wall Street and FinTech

For those who weren’t looking, you might have missed the release of the Framework for FinTechh white paper released by the White House last Friday. It’s the output of the work performed by the National Economic Council’s Adrienne Harris and her team, who I’ve been delighted to support. The paper represents the policy objectives for…

2017 – a decisive year for retail payment services in Europe

In case you missed it, there was an important keynote speech by Yves Mersch, Member of the Executive Board of the ECB, at a conference in France last Friday. It has some key announcements in there, so I’m reproducing the speech here for those interested in immediate payments and what Europe is doing. Keynote speech…

Where’s the ROI in immediate payment systems?

I’m just starting a project on real-time, immediate, faster payments or whatever you call it. It’s basically making a payment that is either settled within seconds or the data is moved and settlement takes place at a later time, but it look immediate. There’s lots of reports out there about immediate payments, with my favourite…

Will the USA see a surge of FinTech banks launch this year?

I write so much that I sometimes forget what I’ve written, where. For example, Mark Sievert of Silicon Valley Bank made an interesting comment on my predictions for 2017: Happy New Year Chris! One topic I am not hearing much about is the OCC December decision to offer Federal Charters to Fintech firms. http://bit.ly/OCCFintech. Many…

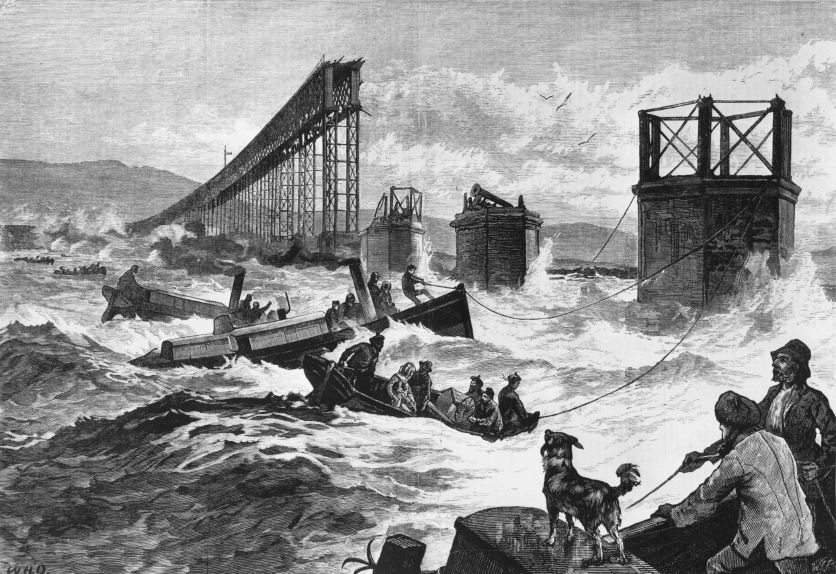

APIs is all about trains, ships and standards

We had a meeting of the Financial Services Club in Oslo last night, talking about the Payment Services Directive 2 (PSD2) and Open APIs (Application Program Interfaces). It was a fun meeting and covered the in’s and out’s of closed versus open APIs, the implications of allowing Trusted Third Parties (TTPs) access to the bank’s…

How do governments regulate a networked world?

Following on from yesterday’s blog about Little Britain and a hard Brexit, we all know the world has been globalising and, even though there is currently a backlash against globalisation per se, it is unstoppable. It is unstoppable primarily because of technology. The whole planet is now on the network. Seven billion people have access…

Real-time connections between regulators and banks is a game-changer

Had a really interesting chat about RegTech the other day. We were debating how regulators have changed in recent times, not just in encouraging start-ups and innovation, but it looking forward rather than backward. For most of the time that I’ve dealt with financial services, regulators have always been in catch-up mode. They regulate what…

RegTech: Brother in Arms with FinTech

During recent months, I’ve enjoyed a real ding-dong of conversations between Europeans, Asians, Americans and Brits about FinTech and, to be more specific, RegTech. RegTech is a couple of years in catch-up with FinTech, and is all about how to use technologies to make regulations more efficient and effective. The claim is that the UK…

Bankers should not be retailers [Wells Fargo]

5,300 Wells Fargo employees have been caught faking customer account openings in order to hit their sales targets. That sounds pretty disgusting doesn’t it, but it’s nothing new. In fact, we here in old America or, as some call it, Britain, have been living with this for half a decade. During the 2000s, leading up…