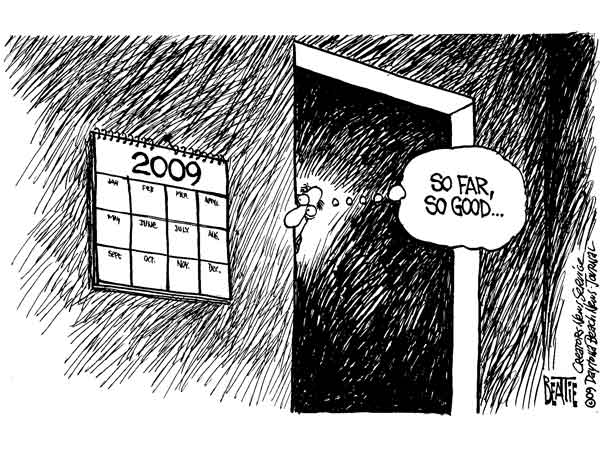

Five banking sector predictions for 2009

Welcome to 2009. For the past couple of weeks, I’ve been posting reasonably frivolous bits and bobs, but now to the serious question: what’s in store this year? For most, 2009 is fairly obviously a year of rationalisation and implementation. Rationalising the issues that led to Lehmans collapse and implementing ways to create liquidity. Rationalising…