Regulation

The real reason for a regulatory sandbox … avoiding death and mayhem

I just spoke at Russia’s Eastern Economic Forum, a Davos for the Russian world and beyond. Hosted by Vladimir Putin there were stellar guests attending including Prime Minister Narendra Modi of India and Prime Minister Shinzo Abe of Japan, as well as other world leaders and Chris Skinner. Hanging out with the heads of Russia,…

How does MiFID II and FinTech work?

Over a decade ago, I curated a book about MiFID – the Markets in Financial Instruments Directive. I don’t blog about this much these days, as my audience is firmly in the retail and payments technology space, but I still keep close track of the investment markets, clearing and settlement, custodial banks and central counterparty…

Who governs the internet?

I have this debate often: Why governments will fail to block the emergence of cryptocurrencies such as Bitcoin Can you have decentralised exchange without centralised control? Is the world being democratised through technology? How do governments regulate a networked world? A world without money A world without government? … and find the answer always the…

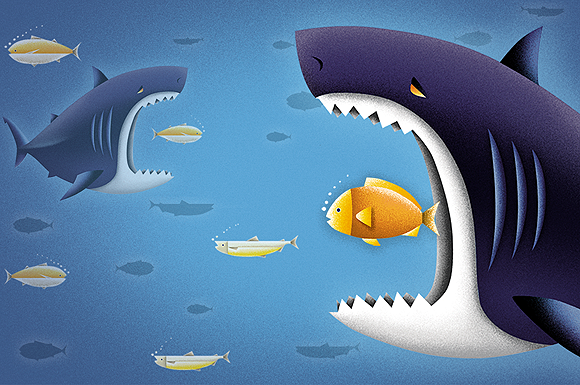

Is Big Tech good or bad for banking … the regulator’s view

Following on from Facebook’s announcement of its own digital currency Libra, the key regulatory body of banking – the Bank for International Settlements (BIS) – which sets standards like the Basel capital reserve requirements, has stepped into the debate and produced a report on their view of the threat and opportunity of Big Tech to…

Time for a global regulator

I was in conversation with a banker the other day and we got around to regulations and regulators, as many conversations with banks tend to do. There were some interesting reflections in that dialogue, however. I guess it falls into three categories: the way regulations used to be; the way they are; the way they…

Does FinTech worry policymakers?

Not sure if anyone noticed that the Financial Stability Board – the world’s central banks tasked with maintaining financial stability – produced a white paper on FinTech last month. It was published on Valentines Day, so you were probably busy, and I only just stumbled across it. Here’s the Executive Summary. FinTech and market structure in…

The next global financial meltdown is just around the corner

Yep, there’s a clickbaiting title if ever I saw one. But it seems to be true. Ten years ago, we had a global financial crisis. Now, ten years later, the banks are heavily regulated, their risk-capital ratios stabilised, their leverage reduced and the regulators breathing down their necks, promoting competition and supporting technology innovators. The…

Compliance will kill the bank

I was talking with a banker at a recent conference, and was surprised by his attitude. He’s not worried about Amazon, Google or Alibaba; he’s not concerned about FinTech start-ups, Revolut or Monzo; he doesn’t really care about Open Banking and software; as for machine learning, artificial intelligence (AI) and the like, you might as…

Why P2P lending works in some markets and not in others

Someone asked me about getting return on investment in fintech. The discussion is about how many firms are actually delivering on their promise. So many unicorns are loss-making firms, and billion-dollar valuations on million-dollar revenues seems like a lot of hype. One article typified this feeling: High-society fintech under pressure to perform for billionaire backers in…