Uncategorized

Banks with pre-internet age core systems have a heart that is no longer beating

I realised something about this new market of fintech the other day, where banks become financial systems integrators. That realisation was that banks really should think about what they are doing, developing so much core capabilities internally. Right now, coders are the new rock stars and banks develop pretty much everything themselves. I can think…

Banks with pre-internet age core systems have a heart that is no longer beating

I realised something about this new market of fintech the other day, where banks become financial systems integrators. That realisation was that banks really should think about what they are doing, developing so much core capabilities internally. Right now, coders are the new rock stars and banks develop pretty much everything themselves. I can think…

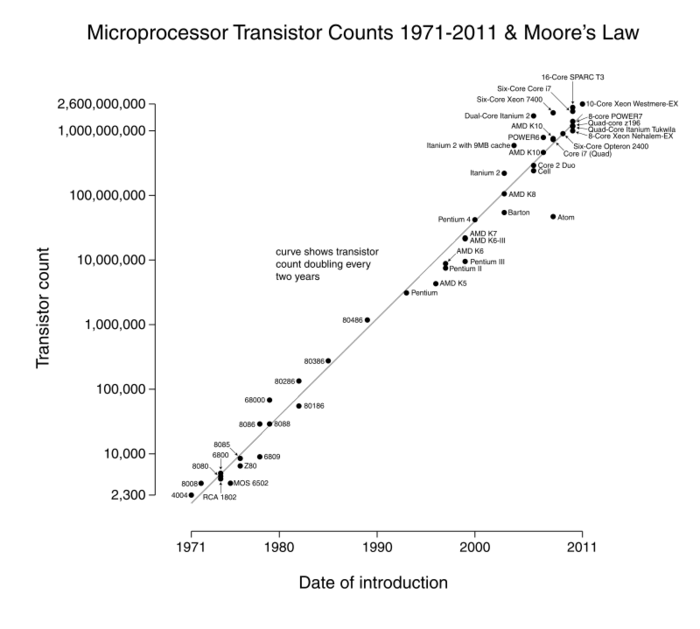

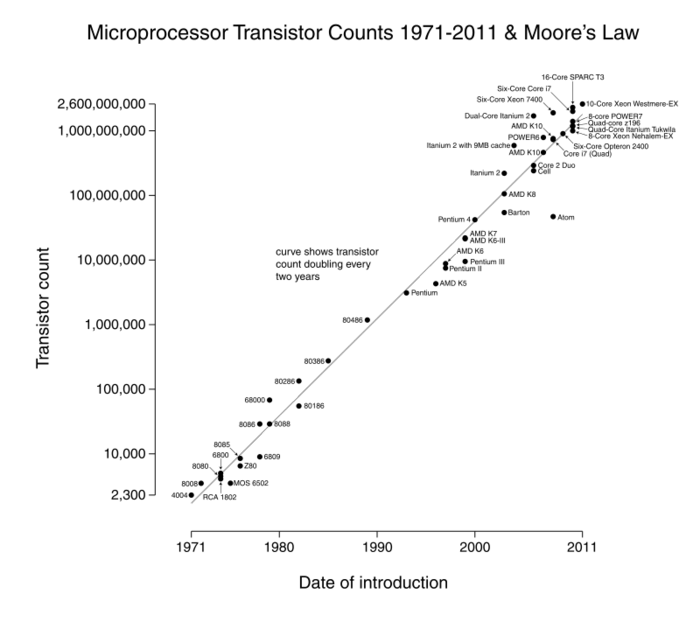

Moore’s Law for Banking Services (and any other)

There’s the famous old law of computing observed by Gordon Moore fifty years ago that compute power will double every two years whilst the cost will halve. It’s stayed pretty much true, as evidenced by this chart: But I have a new one. Mine applies to banking, although it could equally apply to any service-based business,…

Moore’s Law for Banking Services (and any other)

There’s the famous old law of computing observed by Gordon Moore fifty years ago that compute power will double every two years whilst the cost will halve. It’s stayed pretty much true, as evidenced by this chart: But I have a new one. Mine applies to banking, although it could equally apply to any service-based business,…

This new market called FinTech

I blogged a short while ago about Coders being the new Rock Stars of Banking, and how JPMorgan and other banks were actively head hunting leaders in Google, Yahoo and other Silicon Valley leaders. So I was interested to see the headline yesterday, that Snapchat has hired Imran Khan, the former head of Internet banking at…

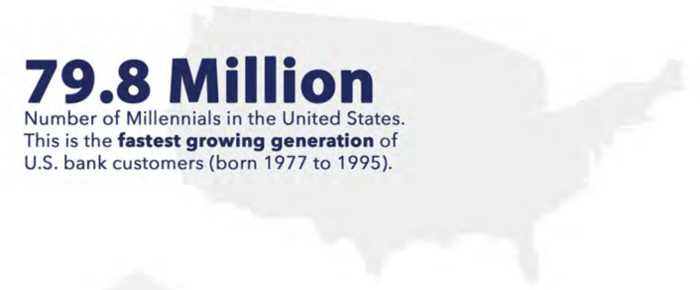

The biggest disruption in banking is NOT technology

Researching crowdfunding and P2P lending, I found three research reports and a newspaper article that give you a tip for the future of banking. The three reports go together and are all about millennials. Yes, that group of under 35s who grew up as net natives or, if you prefer, the folks born after 1980. The…

Merging the suits with the jeans: the new fintech formula

I’ve been spending more and more time thinking about this conundrum of the suits versus jeans brigade, or Bordeaux versus beer if you prefer. If you haven’t caught the drift, it’s all about fintech and how banks (suits) come to work together with tech (jeans). It’s something I’m seeing more and more and my latest…