Uncategorized

Technology: taming the risk beast

After outlining the four main buckets of risk that banks have to tame: market, credit, liquidity and operational; the real issue is the bank’s structure. Historically, banks have been built in product silos and hence there is no sense of enterprise risk. The retail and commercial bank secures funding through the investment bank, but none…

Technology: taming the risk beast

After outlining the four main buckets of risk that banks have to tame: market, credit, liquidity and operational; the real issue is the bank’s structure. Historically, banks have been built in product silos and hence there is no sense of enterprise risk. The retail and commercial bank secures funding through the investment bank, but none…

Risk: the Nature of the Beast

When I first started working in banking, I didn't have much idea about risk, Then I was told about market and credit risk, the two major forms of trading risk in the mainstream markets. Put simply: market risk is the risk of losses from trading whilst credit risk is the risk of the counterparty being…

UK takes a lead in addressing the ‘casino capitalist’ culture

After the huge arguments between London and Brussels over bankers’ bonus levels, where the UK has argued Europe is encouraging our bankers to leave and go to Geneva, New York and Hong Kong, we have now responded by introducing levels of punishment for financial wrongdoing that far outstrips those in Geneva, New York and Hong…

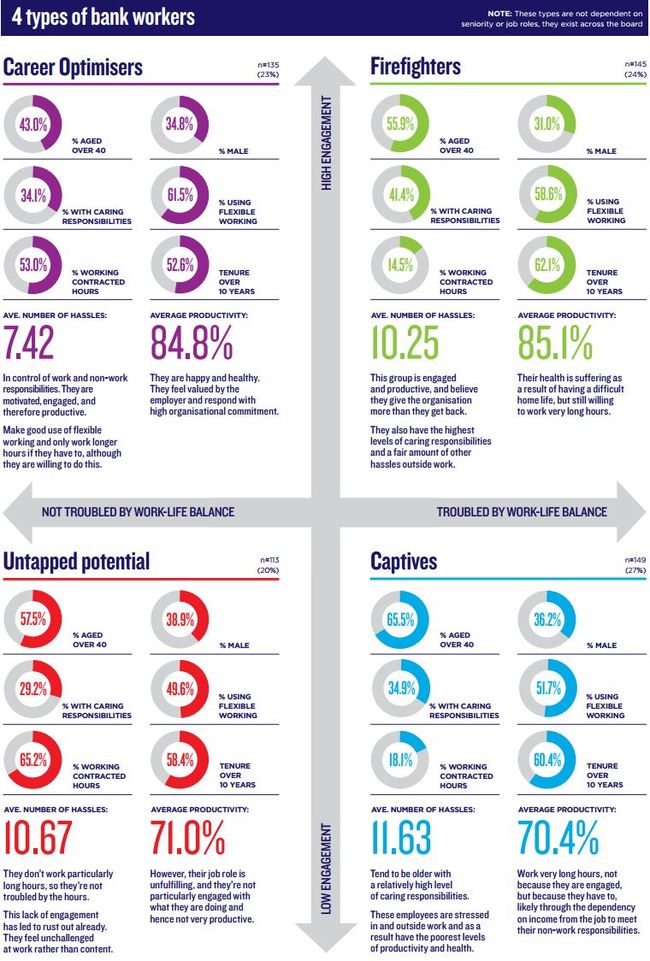

Are you a career optimist or a headless chicken?

I just read some interesting research by the Bank Workers Charity, a charity set up over a century ago to provide education to orphans but, today, a charity that looks after the needs of redundant or sick (not cool, but ill) workers in finance. They’ve been very busy lately. One of the more interesting things…

The biggest barrier to clouds in banking is the banks themselves

Returning to the subject of cloud computing, I mentioned that it is starting to succeed by being more relevant through a vertical focus, but there is still more to be done for cloud to truly take off in banking. In particular, most banks have a concern about the risk of cloud and who is accountable. …

Things worth reading: 14th July 2014

Things we're reading today include … Citi agrees to pay $7 billion to settle securities investigation Bank branches still popular as online banking continues to rise Global fund managers face multi-asset skills shortage Thousands refunded for payday loans Co-op Bank boss to head AIB BIS chief fears fresh Lehman from worldwide debt surge Insurers struggle…

Q: Why are banks organised in product silos? A: McKinsey

I often hear the lament from bankers that their business is designed around products, rather than customers. They have been built upon product silo’s, where customer consistency of experience and interaction falls through cracks. As you look at processes, the hand-off between a customer with a deposit account to their mortgage account, their cards, their…