The end of a ‘bank account’ as the digital me takes over

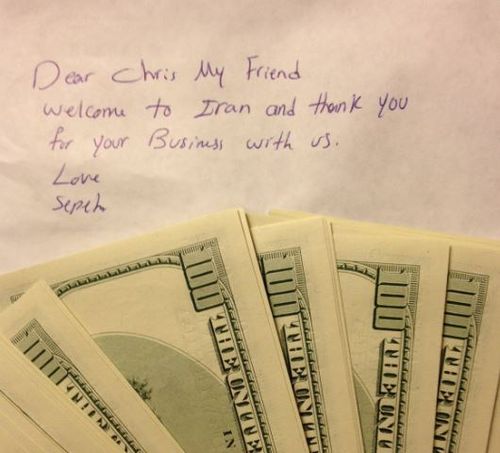

I had a really interesting conversation with Chris Barker, Head of Digital and Engineering for Royal Bank of Scotland. As usual, the conversation moved around data analytics, deep learning, artificial intelligence, building enterprise data systems, separating content from processing, re-platforming the back-end infrastructure and core systems and more. I’ll write more about that stuff tomorrow,…