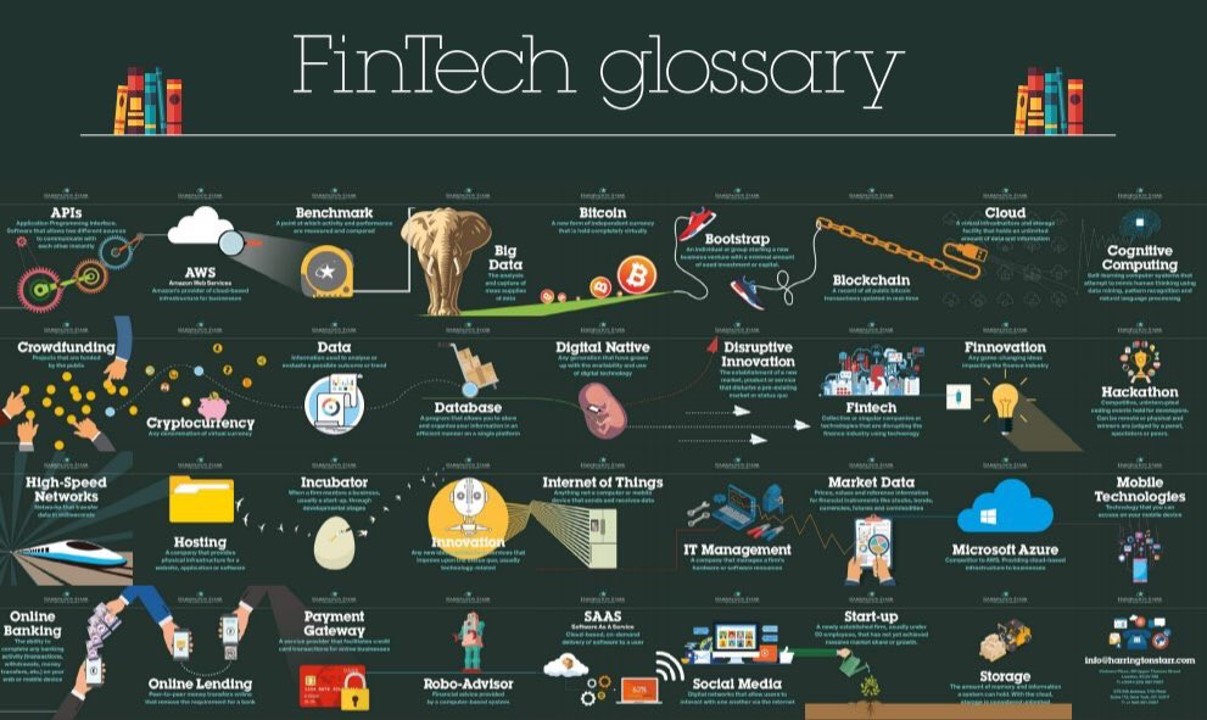

The quagmire of fintech terminologies

Cryptoassets, smart contracts, stablecoins, tokenisation and the two different types of central bank digital currencies (CBDCs) – retail CBDCs and wholesale CBDCs. The world of finance and technology is quite confusing. Add onto this AI, APIs, BNPL, blockchain (Layer 1 and Layer 2), DLT [distributed-ledger technology], machine learning and more, and you get the idea….