Digital Bank

Are big bank fintechs unfairly valued?

I’ve watched Marcus for a while and was not surprised to see its founder is leaving. There are those who are great at building companies and those who are great at running companies. They are rarely the same person. In fact, some of the greatest companies were created by builders and runners. Walt Disney is…

Why do we need banks and branches?

For years, people have argued that you need branches to serve customers for more complex transactions: to serve people who are uncomfortable with digital access; to serve young people getting their first mortgage; to serve retailers and small businesses with their cash needs; and so on and so forth. Baloney. To be honest, I’ve advocated…

Anyone can be a bank … really?

Hmmm … the wonderful Anna Irrera posted an update on Reuters, stating that anyone can be a bank these days, along with her colleague Iain Withers. The article is about embedded finance, a term I dislike. I prefer invisible finance but hey, you win some, you lose some. The article notes that Accenture estimated in 2019…

Banks are creating their own successors

One of the things over-looked by many is how banks invest in the Finverse. According to Toptal’s data, 63% of banks invest in startups or set up accelerators, and many are instrumental in FinTech companies’ operations, fund raising and IPOs. Bear in mind that start-ups need bank accounts too, which creates a multi-dependency in the…

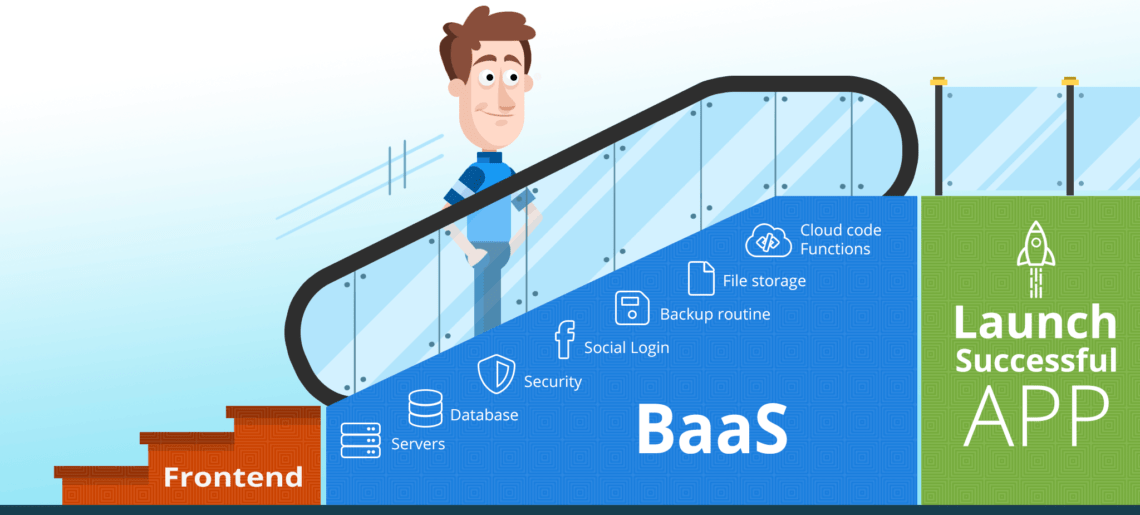

One size does not fit all: the Rubik’s Cube of banking

I recently spotted this post from Panagiotis Kriaris, who leads business development at Unzer: In the era of #APIs, #openbanking and #openfinance, banking has become a totally different game vs what it used to be calling for equally adapted business models. Let’s take a look at #businessbanking and at 4 potential #digital models for banks….

Financial people think digital will beat physical by 2030

I just picked up Deloitte’s report on blockchain where 76% of finance executives have voted that digital currencies may overtake fiat currencies in the next decade*. Most of us would just read that statement and go meh. Not me. That’s a phantasmagorical statement. People in finance think fiat currencies are dead? What? If true, we…