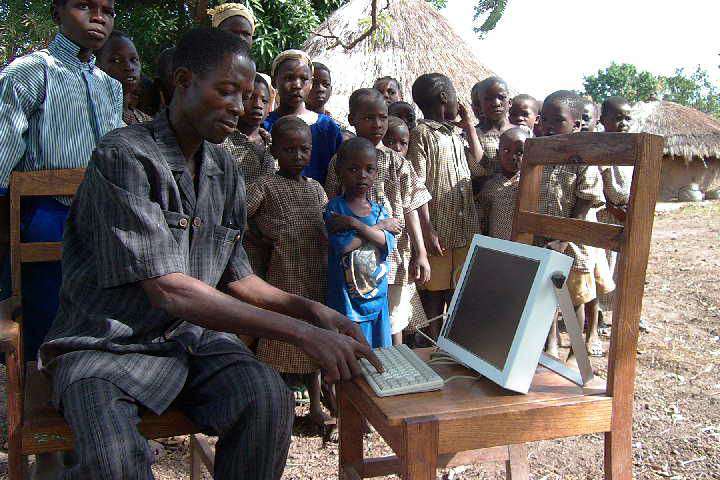

What happens when digital fails?

So, the worst thing imaginable happened today. We had a power outage. I didn’t realise what that meant until it happened. I then realised that I was only maintaining my semblance of sanity during this lockdown thanks to having an oven, a laptop, the internet, power. When the power outage occurred, it suddenly dawned on…