When everything is free, how do we make money?

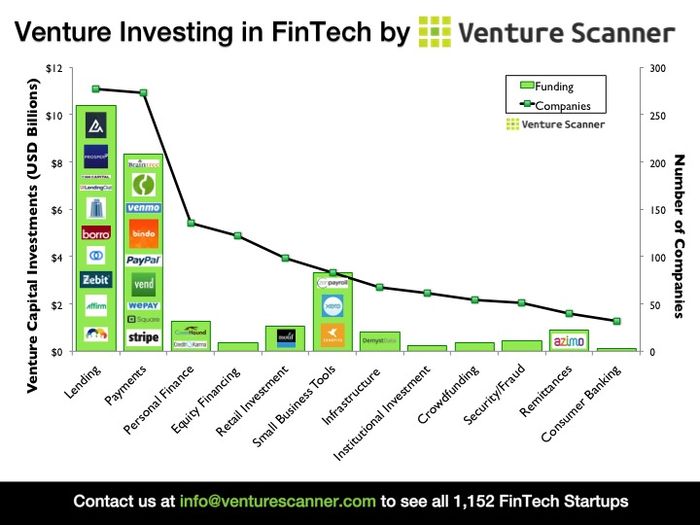

I have this mantra in my presentations about payments. Payments is being attacked by Fintech startups like Klarna, Square, Stripe, Alipay, PayPal (Venmo, Braintree) and more. In fact, according to VentureScanner, it’s the second most active area for investors after lending (P2P and crowdfunding) … … and the most mature sector for new competition to traditional…