FinTech: $6.5 billion invested in first half of 2017

Innovate Finance has just published their report on the first half of 2017, and the investments made in FinTech. Global VC FinTech investment attracts $6.5 Billion in H1 2017 –with UK investment up 37% reveals Innovate Finance H1 2017 saw 787 deals globally, attracting $6.5 billion of VC investment, a 45% decrease year on year…

12 quotes about the future of finance

I recently appeared on an interview with Salesforce’s LeadingEdge webcast. Afterwards, they picked out 12 statements I made that they thought particularly noteworthy, so thought I would repost them here: 12 Noteworthy Quotes on the Future of Banking The digital revolution is fundamentally impacting every industry across the board, and banking is no exception — in…

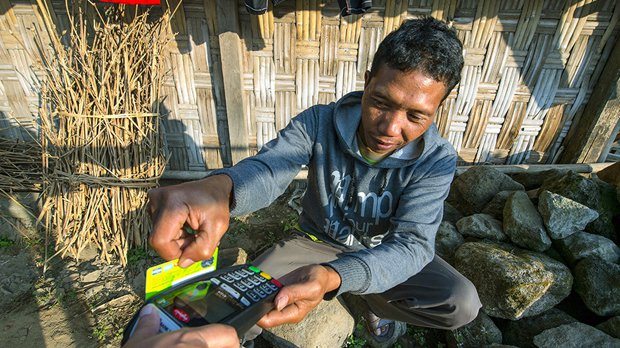

When banking is free …

I really enjoyed a recent article on CGAP (the Consultative Group to Assist the Poor). If you don’t know them, CGAP is a global partnership of over 30 leading organizations that seek to advance financial inclusion. Housed at the World Bank, CGAP’s mission is to improve the lives of poor people by spurring innovations and…

Forking hell … the bitcoin split

There are a few exchanges I use for trading cryptocurrencies such as Kraken and Coinbase, so I was interested to receive this email from Coinbase last Friday: Dear Coinbase Customer, We are contacting you to make you aware of recent developments in a number of proposals for technical changes to Bitcoin. All BTC stored on…

Five financial innovations you may have missed

I just attended an EFMA conference where the opening presentation talked about the most innovative banks in the world. They may or may not be, you can decide, as I’m posting some of their stories here. These are the ones I quite liked, so it’s not exhaustive. See what you think … Capital One Skill for…

What happened to the bitcoin bubble?

I was interviewed by UBS’s wealth management team a month ago, when the bitcoin bubble was in full bloom. The price had exploded, tripling in a month. Now that it has burst, the interview seems quite prescient so, here it is … UBS interview with Chris Skinner Cryptocurrencies – digital currencies based on encryption –…

The first global platform play from Ant Financial

One company that is seeking global domination is Ant Financial. The company has an open stated intention to reach two billion users by 2025. The way in which they’ll achieve that is through local partnerships, and many of those have been started already: Ant Financial invests in Thailand’s Ascend Money as part of global expansion…