Is your next bank manager going to be a robot?

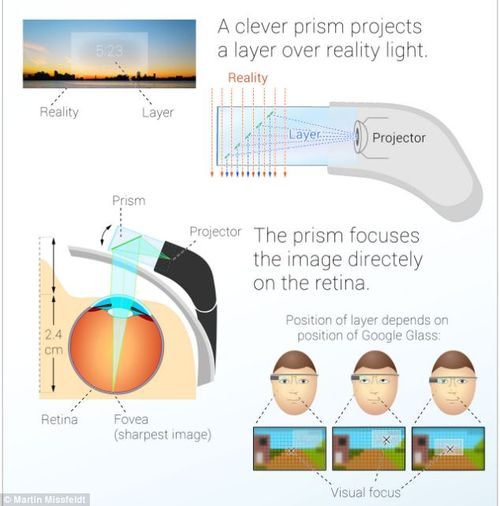

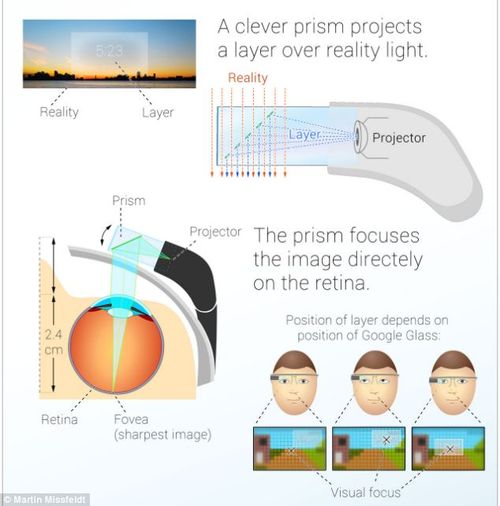

Looking for future trends, it is clear that wearable computing through the internet of things is a big wave for the next five years but, less reported, is the work on robots. Whenever we think of robots, we probably have an image of Will Smith in I Robot or the poster for Metropolis, dependent upon…