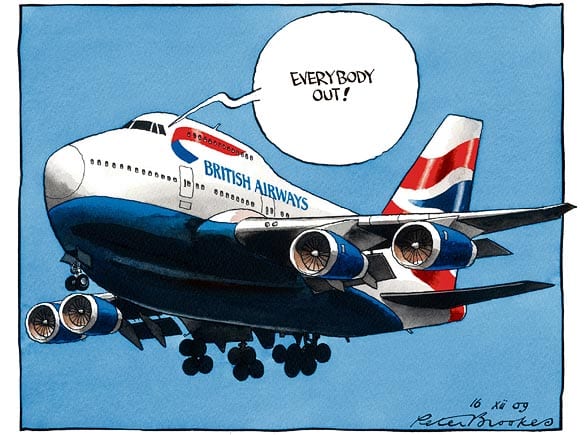

What banks can learn from British Airways

Something happened to me this week that made me think of big bank friends. It’s a different industry and one that, last month, I said we could learn from:the airlines. So, here’s a sobering, learning lesson. I’m a gold member of most airline networks, having flown Star Alliance and One World for years. I’m a British Airways…