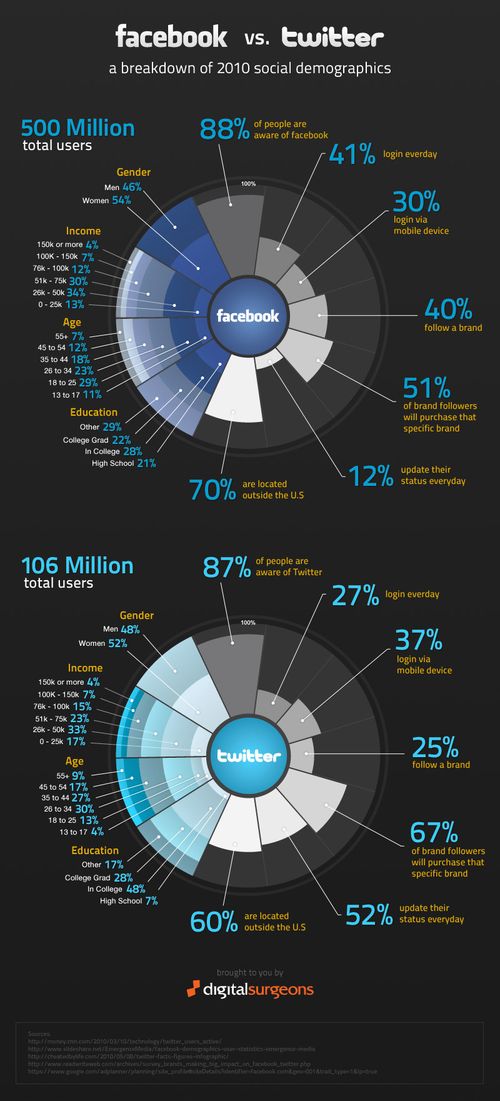

A mass of social media and web 2.0 stats

I like numbers and haven't posted any for a while. So I was pleased to find a bunch of useful social stats while crawling the net the other day. These stats starkly put into context why social networking and social media is important. It's important in all walks of life, especially finance which is…