Uncategorized

Money can’t buy me love … but it comes close

Throughout all my years of dealing with banks, 99% of the people I meet are downright honest, good to share a glass of wine with, people. They work hard, are customer focused and have the best intentions. Their only challenge is their management team and culture. On the one hand, some believe they are doing…

Finance and banking in 2035

Looking at the long term, I tried to think about the effects of today's changes in the political, economic, social and technological spheres would have by 2035. Obviously, there are pure guesses and the list is only a starter for ten, but here are a few clear things that seem likely: Investment banks will not…

Customers no longer fit into neat, age-based demographics

Presenting at a conference recently, the opening keynote began by saying: “we are living with six generations of human, who all have different tastes and needs”. Yep. In marketing speak, he classified them as: Traidtionallists (the World War II Generation); Baby boomers; Generation X; Generation Y; Millennials; and Generation C. I hadn’t heard of Generation C before,…

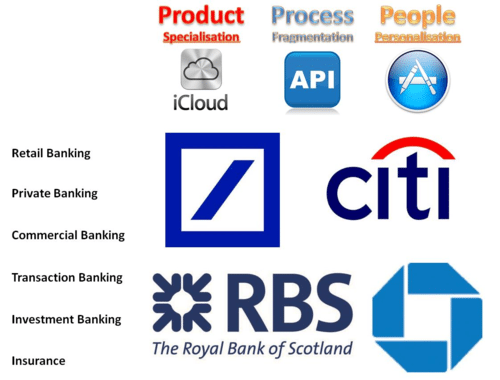

Part Four: Banking on Demand – the Component-Based Bank

For the past three blog entries, I have tried to convey how the old world of products, processes and people – or manufacturing, operations and distribution if you prefer – is being re-engineered by technologies. Cloud-based products and services can deliver the bank products anywhere, anytime; open source processing via APIs allow those cloud-based products…

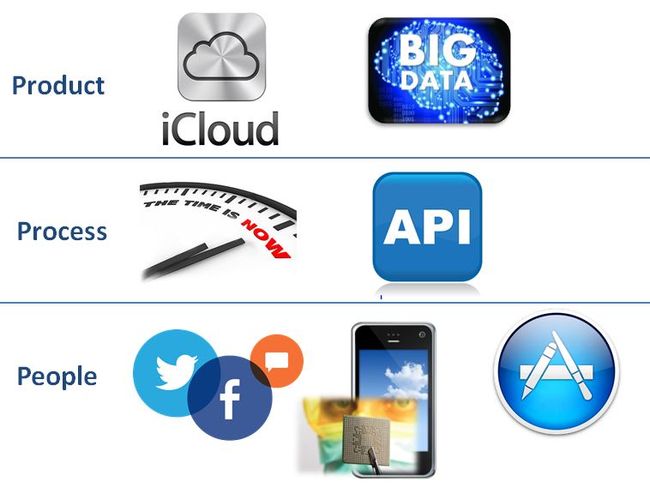

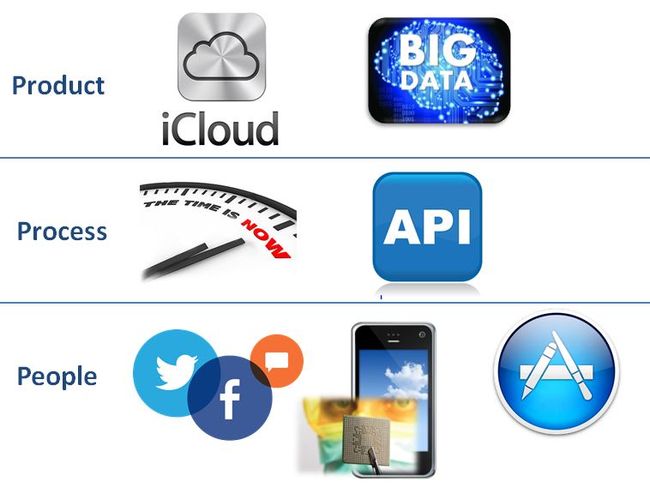

Part Three: Banking on Demand – the Customer Focused Bank

Building upon the previous two blog entries that discussed the new business models in banking based upon products (cloud-shared leveraging data analytics) and processing (real-time via open sourced APIs), we now arrive at the customer layer (mobile and social). Seen as the most important layer, as this is where the relationship between provider and…

Part Three: Banking on Demand – the Customer Focused Bank

Building upon the previous two blog entries that discussed the new business models in banking based upon products (cloud-shared leveraging data analytics) and processing (real-time via open sourced APIs), we now arrive at the customer layer (mobile and social). Seen as the most important layer, as this is where the relationship between provider and…

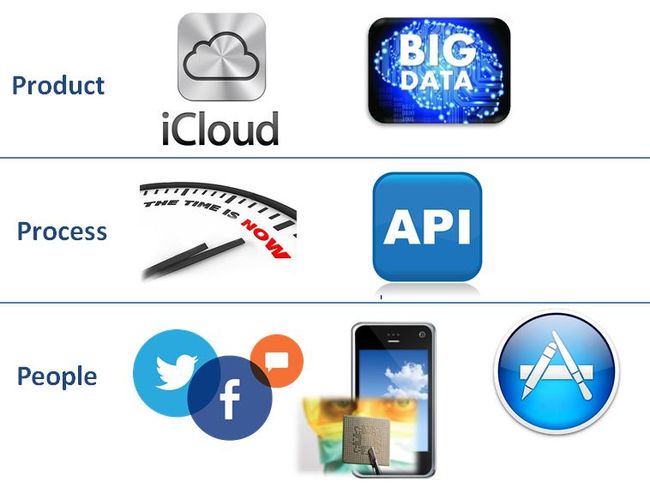

Part Two: Banking on Demand – the Open Sourced Bank

So I started this series of blogs by talking about the age of the Digital Bank and that it starts with these basics: products are cloud-based components that leverage data in the back office to be relevant to the customer in the front office. Building block one: cloud and big data. Building block two: APIs…

Part Two: Banking on Demand – the Open Sourced Bank

So I started this series of blogs by talking about the age of the Digital Bank and that it starts with these basics: products are cloud-based components that leverage data in the back office to be relevant to the customer in the front office. Building block one: cloud and big data. Building block two: APIs…

Part One: Banking on Demand – the Bank in the Cloud

There is a sea change taking place in finance, the economy and the world, thanks to digitalisation and technology. In banking, I’m not sure that it’s seen, or that it is seen visibly, but the sea change is being enabled by seven key technology components right now: cloud and big data in the back office;…