Uncategorized

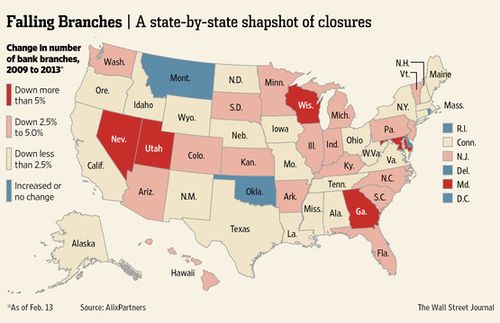

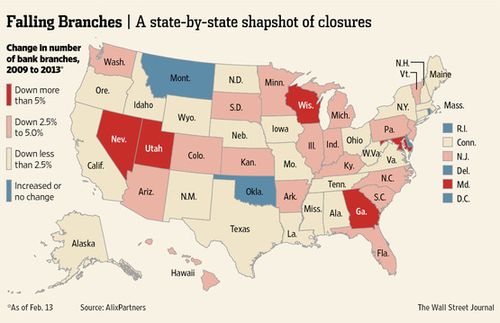

This bank branch is dead … no it’s not! It’s, uh, resting …

I’ve recently seen so many articles about branches and branch closures that it’s worth a blog post, just to keep up with the issue. The first thing that came out was the recent European Central Bank (ECB) data detailing bank statistics over the past few years. From analysing this data, Reuters found that there has…

This bank branch is dead … no it’s not! It’s, uh, resting …

I’ve recently seen so many articles about branches and branch closures that it’s worth a blog post, just to keep up with the issue. The first thing that came out was the recent European Central Bank (ECB) data detailing bank statistics over the past few years. From analysing this data, Reuters found that there has…

Talk about customers, not channels

Continuing on yesterday’s theme, I’ve written often about the fact that I do not believe in a multichannel or omnichannel strategy, just a strategy of how to deliver augmented service to the customer at the point of relevance. For me, that is a digitised delivery of service, proactively via my mobile today and soon my…

Five payments innovations down under

So I just finished presenting as keynote at CeBIT Australia’s Future of Payments conference, when the day was completed by a start-up challenge (you have a lot to answer for innotribe!). The prize on offer was a free stand at the main CeBIT conference for the winning entry, and five firms were given just seven…

How the decomposed bank will compete

Building upon yesterday’s discussion – where your product is a username, your processing is an API and your customer engagement is just an app – I was talking to a bunch of banks and new entrants about Big Data opportunities today and realised ONE BIG THING. Banks need to start making strategic decisions before it’s…

Banking decomposed or decomposing banks

What happens when your product is a username, your processing is an API and your customer engagement is just an app? It’s a question I’ve been playing with for a long time now: BaaS: Banking as a Service, February 2009 The future competitive battleground, November 2011 Why all banks will change core systems, April 2013…