Uncategorized

What Star Trek tells us about banking

For years, I’ve been a fan of Star Trek, and have used their innovations in many presentations, but I’ve always wondered: how come there’s no money on the Star Ship Enterprise? Is everything free? Not exactly. My supposition was that the future world of Star Trek, bearing in mind that it’s set in the 24th…

Banks spend billions on risk management IT, but is IT working?

I was chairing a conference about risk and regulation today, and opened with the view the it is the culture of banking that needs to change. You can force the change through regulation, but if banks really want to be able to prosper post this crisis, then it needs cultural reform. And it’s not about…

The Financial Services Club Season, London, Q4 2012

We are pleased to announce details of our Winter Season of meetings of the Financial Services Club, London. If you would like to attend any of the meetings, please go to the fsclub.net and register. Tuesday, September 25 2012 Alex : 25 years of satirising the City Charles Peattie and Russell Taylor, creators of…

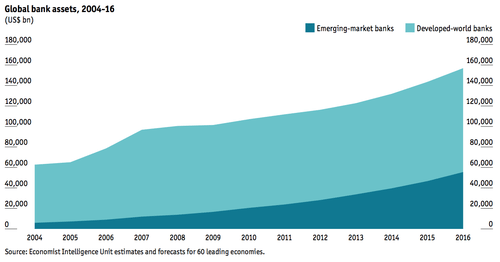

Banks biggest opportunities lie in emerging markets

I just received a report from the Economist Intelligence Unit (EIU) on new bank models based upon different styles of banking in emerging markets. According to the report, the BRIC economies and their brethren will account for 35% of global assets by 2016, up from 24% today and just 10% in 2004. Emerging market banks are growing…

The World’s Global Language is English

I started another debate yesterday after saying that English is the global language. It is. It is not the largest spoken language – that’s Mandarin Chinese – but it is the largest global language spoken across borders thanks to the internet. English is spoken as a second or foreign language by an estimated 950 million…

Have banks lost IT?

Further to yesterday’s dialogue around TQM, I got into a conversation with a couple of folks about the fact that we don’t have real STP, Straight Through Processing, in most financial firms. One senior manager said that he had started focusing upon STP back in the 1970s and couldn’t believe that, thirty years later, we…

When TQM means Totally Quack Management

When I was growing up in business, there weren’t many management gurus around. In fact, I think there was just one: Peter Drucker. Drucker was the book for every student of management. He was it. Then I moved into industry and another book came out: In Search of Excellence. This one was by Tom Peters…

Britain: a nation of whiners (except during the Olympics)

Which? Magazine stirred up the old debate about free banking yesterday, by publishing a report which shattered the image of free banking being free. They asked over 2,000 consumers how they felt about banks and more than 60% of those surveyed said they had paid a bank charge that they thought was "unfair, hidden or disproportionate"….