How the Russian mafia use the banking system (especially Britain’s)

I was wondering what to blog about today, as it’s grey and cold and wet and miserable and … then I realised, I should blog about Russia. Here in London, we’ve gradually seen a takeover of some of our key financial and national assets by billionaires from the former Soviet Union states. Some of these…

Next generation authentication: DNA?

I’ve blogged often about the issues of identity, passwords, lack of security and the whole gamut of how mobile internet combined with social media changes everything. Now it’s hit the mainstream media when British Airways magazine has its main front page talking about cybercrime. The first line gives away the rhythm of the article: “How…

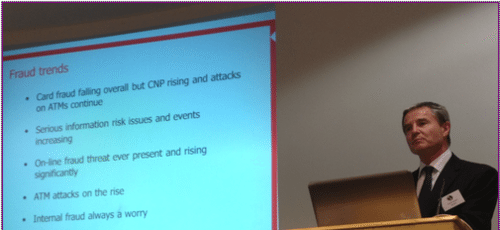

What is an acceptable level of fraud?

Derek Wylde, Group Head of Fraud at HSBC, presented at the Financial Services Club last week. He talked about many aspects of fraud and risk, and presented quite a few numbers related to the issue. One of the charts raised questions in my mind. It related to the total cost of payment card fraud. According…

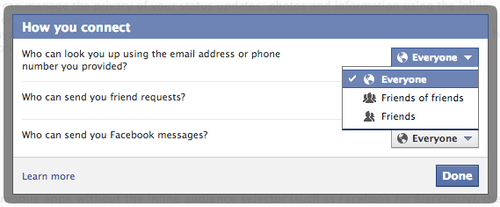

There is no effective identity system, which is why laundering succeeds

The converse of KYC and AML is identity management. If we had effective identity management where everyone could be identified as a unique person with certainty and securely, we would not have the issue of AML and KYC given to the banking system. The issue with identity is that no-one wants to own the problem….

So how should a bank protect itself from hacktivists and cybercrime?

The real challenge for the banking system is how to protect their firewalls from attack by hacktivists, goverworms and cybercriminals and, conversely, how to deliver easy access to online banking for their clients and customers. It’s a real dilemma. On the one hand, everyone wants mobile access to his or her account balances and to…

Cyberwars: a far bigger threat than hacktivists

Whilst consumers are electing the next major political leader via crowdsourced populism, governments and companies begin developing cyberarms. This cyberwarfare is already rife, with a host of malware targeting middle eastern nations (see end of blog entry). What is obvious from these developments is that cyberattacks are the new form of warfare that evades direct…

Who are you f-ing Americans?

Standard Chartered paid off the new Sheriff of New York City, Benjamin Lawsky, to the tune of $340 million to get rid of the pest. As Investec's commentator Ian Gordon said yesterday, they “acted with pragmatism and integrity in the face of extreme provocation”. What really gets me here is the whole USA versus the rest…