Digital Bank

Who wants to be a (Fintech) Unicorn?

For the past year, there’s been lots of talk about Fintech Unicorns – start-up companies with over a billion dollar valuation launched since 2000. Jim Bruene at Finovate – register for Finovate Europe with 20% discount using FSClub20 – wrote about so many Fintech unicorns in July 2015, showing the list increasing four-fold in just a…

Are bankers just rearranging deckchairs?

I had a really interesting evening this week, moderating an industry roundtable with panel participants including: Cliff Moyce, Strategic Adviser, DataArt Chris Barker, Managing Director, Global Head of Digital & Engineering Services, RBS, Mike Powell, Managing Director for enterprise capabilities, Financial & Risk, Thomson Reuters Scott Eblen, Chief Product Officer, Nutmeg Frank Neumann (COO, Quantstore)…

The end of a ‘bank account’ as the digital me takes over

I had a really interesting conversation with Chris Barker, Head of Digital and Engineering for Royal Bank of Scotland. As usual, the conversation moved around data analytics, deep learning, artificial intelligence, building enterprise data systems, separating content from processing, re-platforming the back-end infrastructure and core systems and more. I’ll write more about that stuff tomorrow,…

Harumph … I didn’t join this bank to get technical

In the 1970s, Walter Wriston, the then CEO and Chairman of Citibank, said that “information about money is becoming more important than money itself”. His successor, John Reed, said that “banking is just bits and bytes” in the 1980s. How right they were, and this just underscores how important digitalisation is to banking. We have…

The European Digital Bank Plan: It’s Official!

I was honoured to be invited yesterday to address the European Banking Federation’s (EBF) annual conference in Brussels. There were many dignitaries there, as well as a number of senior Eurocrats, and so felt that my message of Fintech, Blockchain and Real-Time for Free might fall on resistant ears, but quite the opposite. I was…

More evidence of banks waking up to the digital reformation

I have seen several banks note, and particularly two in the past week, that shows the shift of thinking as we move to the hybrid world of technology and finance. Most talk about Fintech start-ups but these two show a different perspective. First, Derek White of Barclays talks a lot with Business Insider about blockchain and…

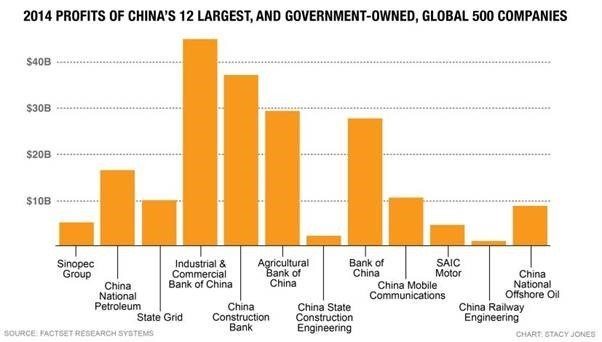

Will bank developments in China lead to a global banking revolution? [Part Two]

This blog was first published on SAP for Banking, 26th August 2015 and is Part Two or a two-part series. Part One was published on 12th August. Will Alipay and Wechat get Amazon and Google into banking? No-one can ignore the developments taking place in China’s banking system, as their two largest internet players launched banks…

How to wake up the bank

I recently had a great conversation with the head of innovation at a bank. In the middle of the conversation, we got into a discussion about how to get rid of complacency in the management team. The fact is that this bank is doing well. It’s growing its customer footprint, cross-sell ratio, account holdings, deposits…