Digital Bank

Open Finance? It’s all about the C’s!

We had a great discussion about Open Payments, Open Banking and Open Finance at FinTech Week London* this week. What was interesting is that nearly everyone opened with a mention of customer and customer journeys. Customer is the critical factor here, and customers don’t care whether they’re using Open Finance or not. What they care…

An interview with EFMA about the realities of digital for good

I just had a nice interview with EFMA (now Qorus) about the new book Digital for Good (available here), and thought I would share the interview here. Hope you like it. Qorus- It is not always easy to distinguish genuine leaders from clever communicators. How did you select the different people you gave the floor…

The neobank era is just beginning

Good friend Ron Shevlin sparked off a great debate about neobanks with his snarky column on Forbes the other day. His basic argument is that neobanks are over. A few choice passages: The 10 leading neobanks in the US grew by a little more than 10 million accounts in 2021, from 23.3 million to 33.5 million, according to…

A circular economy or degrowth?

I launched the new book Digital for Good in London the other day, and was joined by many friends in my network. The main highlight of the event was a panel discussion on where we are going with four panellists: Gail Bradbrook, Co-founder, Extinction Rebellion Gihan A.M. Hyde, Founder & CEO, CommUnique Tram Anh Nguyen,…

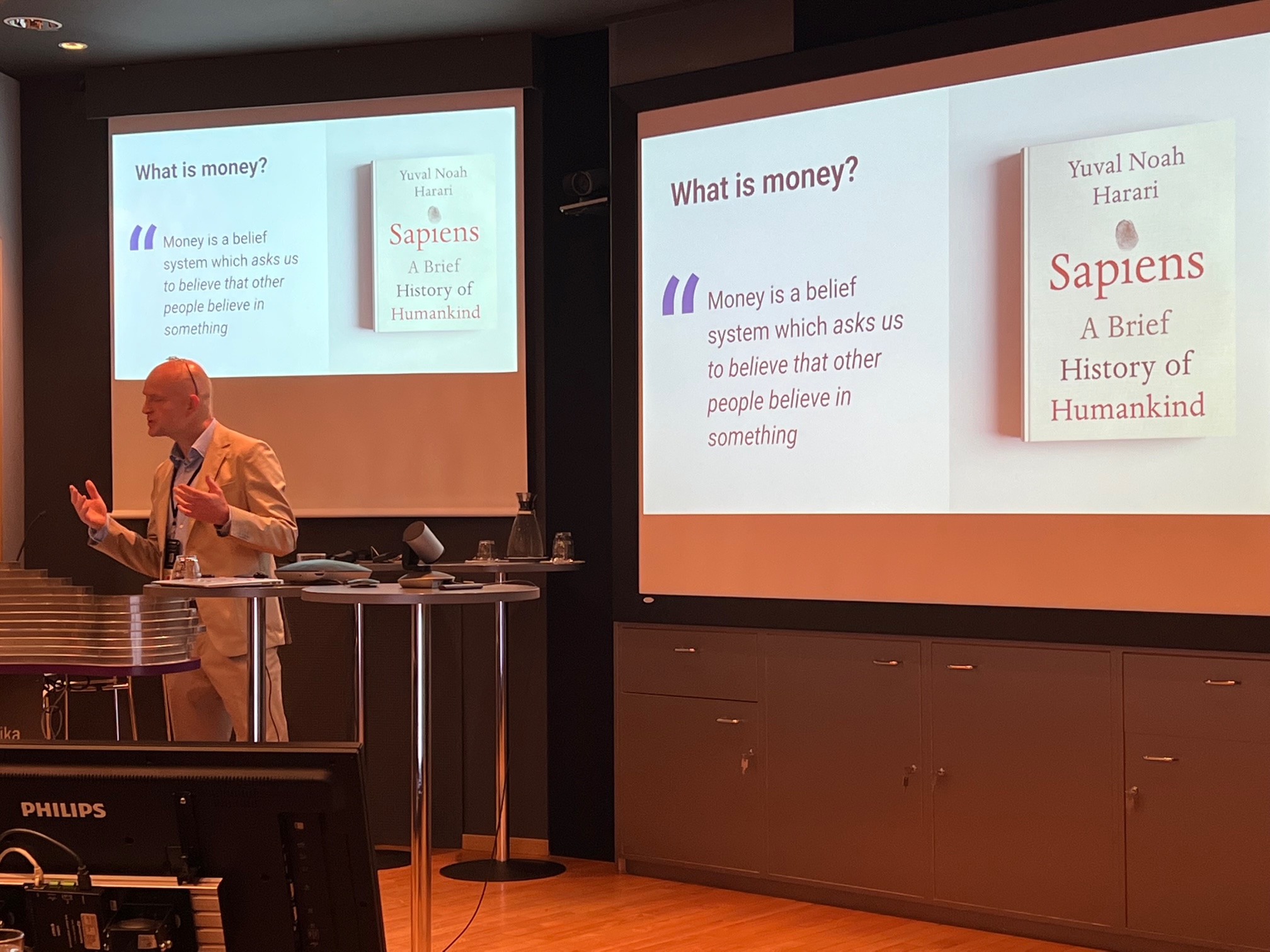

Money is just a belief

We had a great session in Oslo last week focused upon: what is money? The question comes up more and more in my thinking, especially when you look at cryptocurrencies, CBDCs, stablecoins and such like. We had many good presentations from MasterCard, the Norwegian Central Bank, Handelsbanken and even cameo Zoom appearances from Dave Birch…

Forget rock and roll, it’s now space and soul

I am regularly asked: what’s the next big thing? Answer: there isn’t one. There are just all the things we can see today that are building to the next big thing. What’s out there today? Web3; the metaverse; cryptocurrencies, digital currencies and CBDCs; artificial intelligence plus; blockchain, smart contracts and distributed ledger technologies in reality;…

Is Apple finance going to change the world?

There’s a regular debate about whether BNPL (Buy Now, Pay Later) is a good or bad thing. There’s a big call for it to be regulated and comparisons with payday loans are made often. Nevertheless, it makes sense as many companies are now grabbing a slice of this space. The latest one is Apple. It amused…

And what happens when digital fails?

I have another concern about digitalisation, which is what happens if you’re knocked off the grid? What happens if you lose your password? What happens if the company does not recognise you? What happens when someone takes over your persona? What happens when your balance of six figures is suddenly zero? OK, sure. These things…