Digital Bank

Is banking like driving?

I participated in a call the other day about financial inclusion and the moderator said that giving people banking was like giving a child the keys to your Ferrari. Without education, they would crash it so, rather than financial inclusion, you need inclusive finance. It was an interesting perspective, and made me think about the…

The case for cannibalising the bank

I was thinking about run the bank, change the bank, and the challenges therein. Part of it was down to a conversation that repeats quite often about it being easier to launch a new bank than change the old bank. Something I’ve argued against regularly. Reason being: what are you doing with the old bank, its…

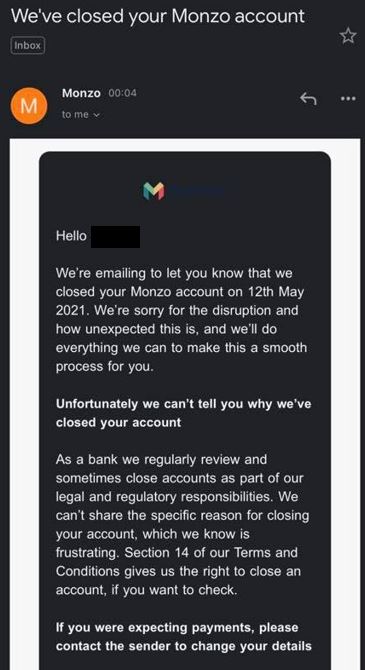

The challenge for challengers (#Anna Money, #Monese, #Monzo, #N26, #Pockit, #Wirex +++)

I’m starting to worry about FinTech as they seem to have fallen foul of regulatory compliance and, as a consequence, customer trust. The biggest challenge for a challenger is to keep customer trust AND regulatory compliance. This is what we are seeing having consequences today. The fact I’m starting to worry about FinTech, as an…

Are Monzo’s growing pains, major pains?

Building on yesterday’s blog where I mentioned Monzo’s issues of client onboarding, I mentioned that, for the past few months, I’ve noticed many tweets from Monzo customers about accounts being closed suddenly, with no explanation. Each time, I’ve shared the information and copied Monzo and asked them to explain. Hey Chris 👋 Thanks for expressing…

Is new banking ten times (10x) better?

Investment banking, Corporate banking, Commercial banking, Private banking and Retail banking are all very different. Too often, commentators just talk about ‘banking’. It’s not all the same. In fact, an awful lot of retail banking is propped up by investment and commercial banking. That’s where the money is made. Banks don’t make money out of…