Money is just a construct and it’s being deconstructed

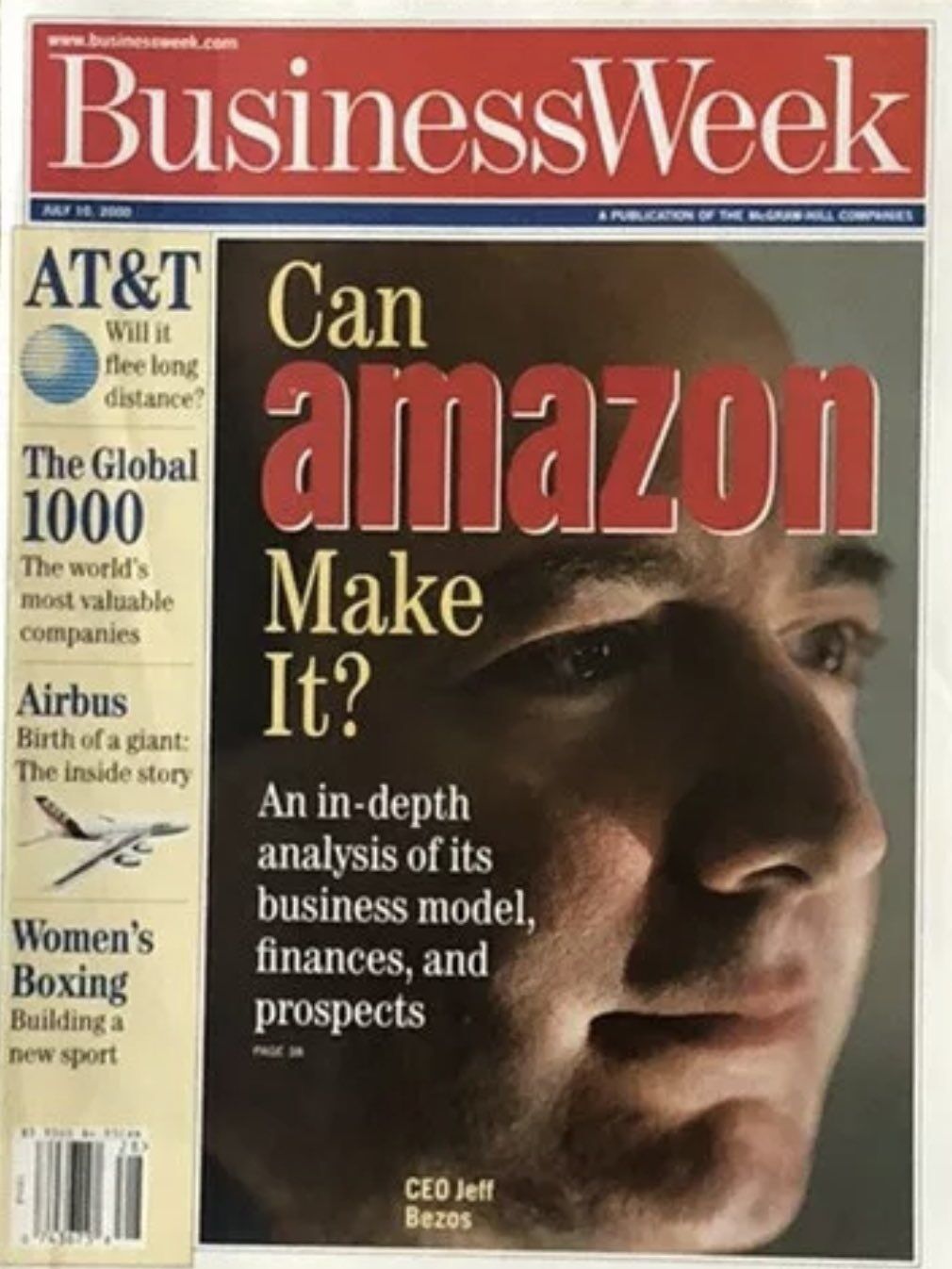

Building on yesterday’s blog, it’s an interesting moment in time. The old world structures reject cryptocurrencies whilst the new world structures accept them en masse. This was typified for me by a couple of headlines the other day: UK Bank NatWest Bars Businesses That Accept Crypto Signature Bank Goes Head-to-Head With Silvergate in Bitcoin-Backed Lending…