Banks are product not customer focused

I walked into a grocer’s store the other day. The store was resplendent with fruits of all colours and continents. There were red, yellow and green peppers; carrots, courgettes and cauliflowers; oranges, apples and bananas of both large and small; watermelons, honey melons and mangoes; green grapes, red grapes and grapefruits; and more and more…

Are challenger banks winning or losing?

I don’t get The Financial Times editorials these days. Last month, they published a ridiculous article about challenger banks eating the banker’s lunch – which I covered here as being the crumbs off the table of the banker’s lunch – and this month, they publish a totally contrary view that the large banks have steamrollered over…

The real reason for a regulatory sandbox … avoiding death and mayhem

I just spoke at Russia’s Eastern Economic Forum, a Davos for the Russian world and beyond. Hosted by Vladimir Putin there were stellar guests attending including Prime Minister Narendra Modi of India and Prime Minister Shinzo Abe of Japan, as well as other world leaders and Chris Skinner. Hanging out with the heads of Russia,…

Where Top US Banks Are Betting On Fintech

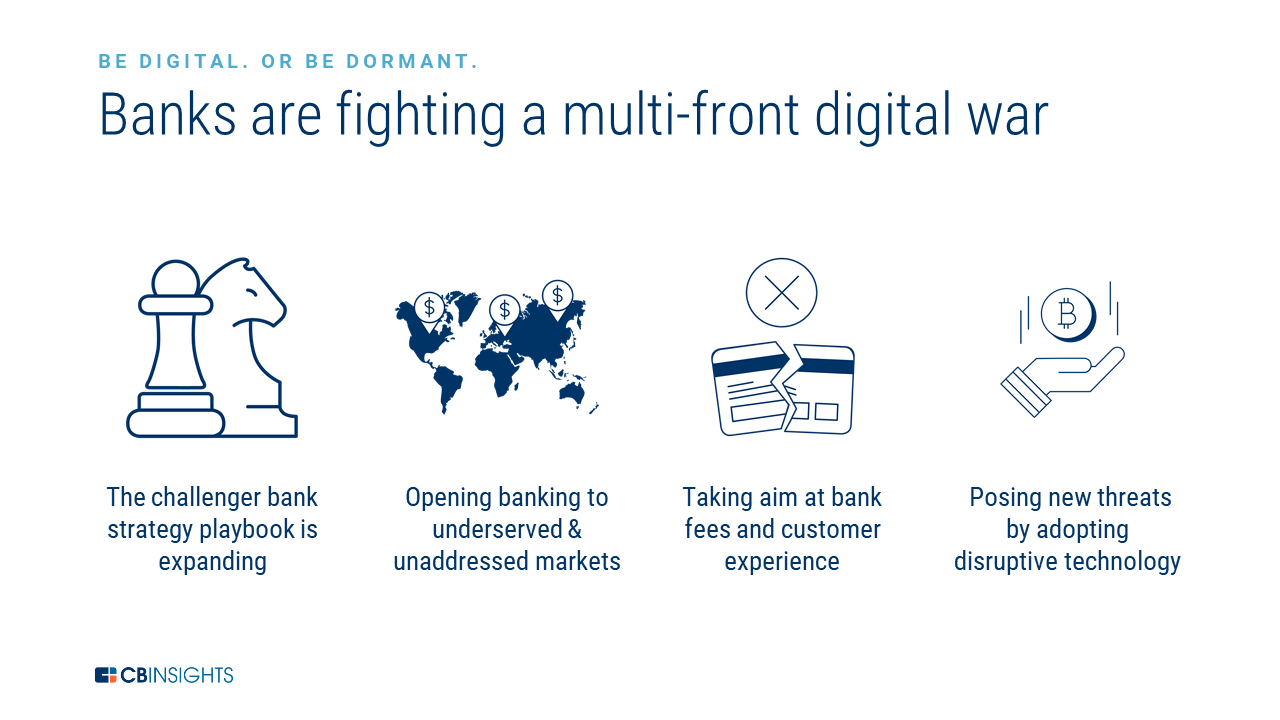

After yesterday’s article about how backward America is, in terms of payments, there’s a useful article talking about how they’re trying to rectify this. Bearing in mind that the big American banks are all spending $10 billion plus each on technology, they should be updating, and CB Insights latest installment looks at where the top American…

Who needs a blockchain?

I often say that blockchain is one of the most complex areas, combining all we don’t know about technology with all we don’t understand about finance. It’s a big hole of acronyms, confusion and debate. Some things that claim to be blockchain don’t use blockchains, and some blockchains claim not to be blockchains but blockchain…

The economics of the network

I often talk about the business model of a bank (or any business) being made up of three major parts: A back office that manufactures the product and administers the service; A middle office where the infrastructure is built to connect the back and front office; and A front office where the relationship exists between…