TARGET2 for Securities [T2S] – the latest news

The ECB just released their latest Quarterly Update Magazine and, as we have a plenary meeting of the Clearing & Settlement Working Group next Tuesday, I thought you might be interested in an update on T2S from the ECB. T2S Programme Plan The T2S project is on track and progressing according to the Programme Plan, which…

TARGET2 for Securities [T2S] – the latest news

The ECB just released their latest Quarterly Update Magazine and, as we have a plenary meeting of the Clearing & Settlement Working Group next Tuesday, I thought you might be interested in an update on T2S from the ECB. T2S Programme Plan The T2S project is on track and progressing according to the Programme Plan, which…

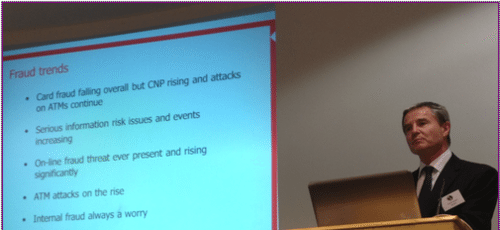

What is an acceptable level of fraud?

Derek Wylde, Group Head of Fraud at HSBC, presented at the Financial Services Club last week. He talked about many aspects of fraud and risk, and presented quite a few numbers related to the issue. One of the charts raised questions in my mind. It related to the total cost of payment card fraud. According…

More reaction to the RBS glitch

After last week's post about the meeting we had at the Club regarding the RBS glitch, I received an email from one attendee, Peter Miller. Well worth a read so I thought I would post it here as additional input to this challenging and important area in our group. Last week’s Financial Services Club meeting,…

The future of payments and technology

Andrew Vorster, Vice President of R&D and Adam Banks, Chief Technology Officer for Visa Europe delivered a fascinating double act at the Financial Services Club the other night. The theme of the presentation was: the future of payments and technology, and covered seven key trends that Andrew and Adam have identified that will disrupt payments:…

Do banks need branches?

We had a great debate at the Financial Services Club last night, picking up on that perennial debating point: do banks need branches? In the pro-branch corner were Anthony Thomson, co-founder of Metrobank and Ron Whatford, former Chief Experience Officer with Lloyds Banking Group; in the anti-branch corner were Mark Mullen, CEO of First Direct…

25 years of Alex, a celebration

We entertained Alex at the Financial Services Club last night … … or rather, we entertained Charles Peattie and Russell Taylor, Alex’s creators. Or rather, they entertained us … It was an enthralling evening and a walk down memory lane for some of us, as Alex is 25 years old! He started with mobile telephones…