The Finanser’s Week: 7th February 2022 – 13th February 2022

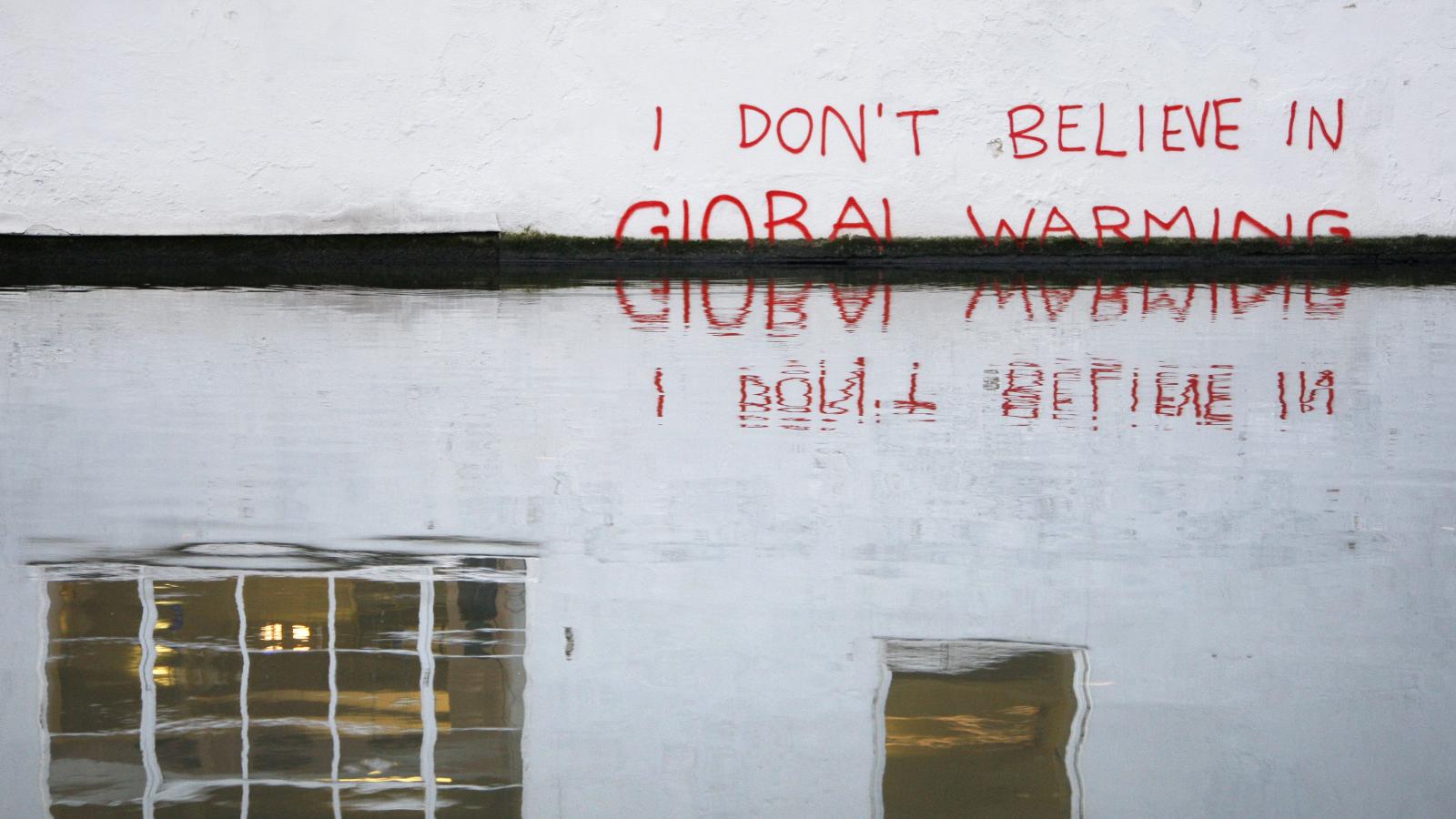

This week’s main blog discussions are … A banker responds to Extinction Rebillion’s call I had quite a lot of response to Gail Bradbrook’s post on February 1. It would be too much to share all, but this particular email from a friend (former CxO at a Big Bank) was the most detailed and illuminating,…

The K-curve economy, where upside is digital and downside is physical

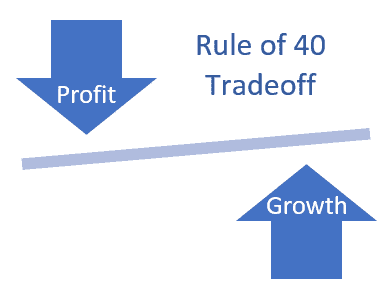

I’ve talked a little bit about a K-shaped economy. The upside of the K is digital; the downside is physical. This really struck home with me when I saw the latest retail sales developments in the UK. According to the Office of National Statistics (ONS), Brits now order a third of their shopping on apps…

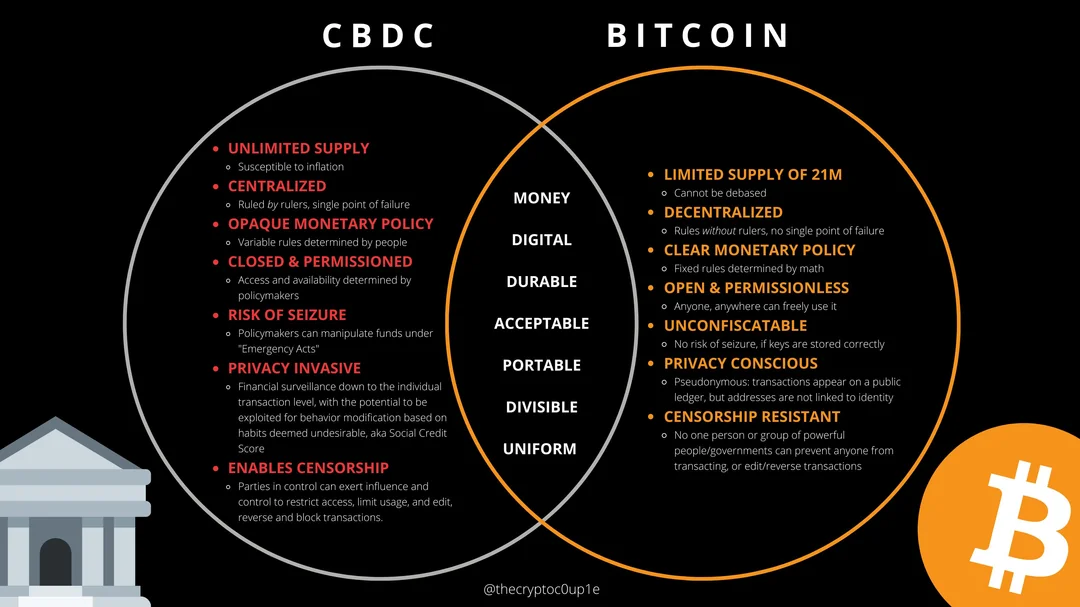

What are Stablecoins?

The Federal Reserve issued a paper about stablecoins at the end of January. There’s lots of good content there, but I particularly liked the way in which they opened the discussion which I have copied here (for full report click here). The basics of stablecoins Stablecoins are digital currencies recorded on distributed ledger technologies (DLTs),…

Does the regulator think that banks are clouding the issues?

During the lockdown, banks moved rapidly to sign cloud contracts. Thing is they were signing with the likes of Amazon, Google and Microsoft, but these are all American firms. Where are the European ones? I raised this issue two years ago, but it is now coming to a head as new rules require banks to…

The Finanser’s Week: 31st January 2022 – 6th February 2022

This week’s main blog discussions include … FinTech’s growing pains and toxic cultures I find it interesting reading the articles about toxic cultures at Revolut. If you Google “Revolut Culture”, the second search item is this one: “You’re nothing but a number to them with dollar signs attached.” That’s how Revolut, one of the fastest…

FinTech’s growing pains and toxic cultures

I find it interesting reading the articles about toxic cultures at Revolut. If you Google “Revolut Culture”, the second search item is this one: “You’re nothing but a number to them with dollar signs attached.” That’s how Revolut, one of the fastest growing fintech startups in the UK, described traditional banks when advertising for business…

Chris Skinner Keynote, April 2025, Europe

Intelligent Money: Our Future Is Where We Do Not Think About Money, As Our Money Thinks For Us

What is the future?

Learn more about Chris

The Past, Present And Future Of Banking, Finance And Technology

Fintech expert Chris Skinner: countries need digital transformation to remain competitive

Join me on Linkedin

Follow Me on X!

Hire Chris Skinner for dinners, workshops and more

Chris’s latest book

Chris Skinner’s ‘Intelligent Money’ Book Launch Event

Top 30 Regtech Blogs

Top 40 UK Fintech Blogs

Lifetime Achievement Award

Kids creating the future bank | TEDxAthens

Alex at the Financial Services

Gaping Void's Hugh MacLeod worked with the Finanser