Banks are creating their own successors

One of the things over-looked by many is how banks invest in the Finverse. According to Toptal’s data, 63% of banks invest in startups or set up accelerators, and many are instrumental in FinTech companies’ operations, fund raising and IPOs. Bear in mind that start-ups need bank accounts too, which creates a multi-dependency in the…

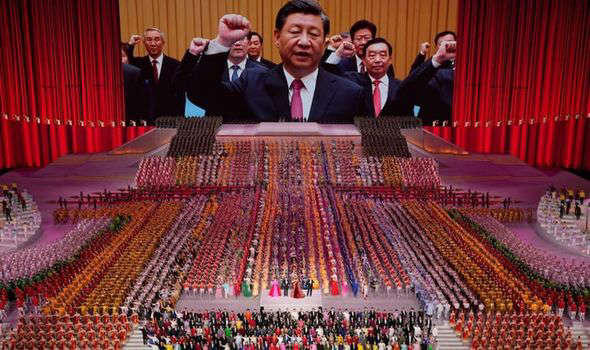

What is President Xi’s agenda?

I was talking with a friend in Asia and went back to my traditional discussions of how Asia, Africa and LatAm markets are shaking up finance more than Europe and America. They then asked me the difficult question: But what about President Xi? Urmmm, what about President Xi? Well, it’s the question of China’s recent…

Will you take the red or the blue pill?

What is time? Do you have any idea? What is the time right now? Does it exist? Einstein says ‘no’. “Time does not exist. We invented it.” Some guy called Albert pic.twitter.com/JS9JMfEyJk — Chris Skinner (@Chris_Skinner) August 28, 2021 Building on Einstein’s quote, I used to regularly present that the world has no borders. We…

The Finanser’s Week: 6th September 2021- 12th September 2021

This week’s main blog discussions include … What if you had “f**k you money”? I was quite taken by South Park’s co-creator Matt Stone talking to Bloomberg, about a deal where he and his co-founder Trey Parker just got paid $900 million to make six more seasons and 14 movies. His specific comment: “As you can…

One size does not fit all: the Rubik’s Cube of banking

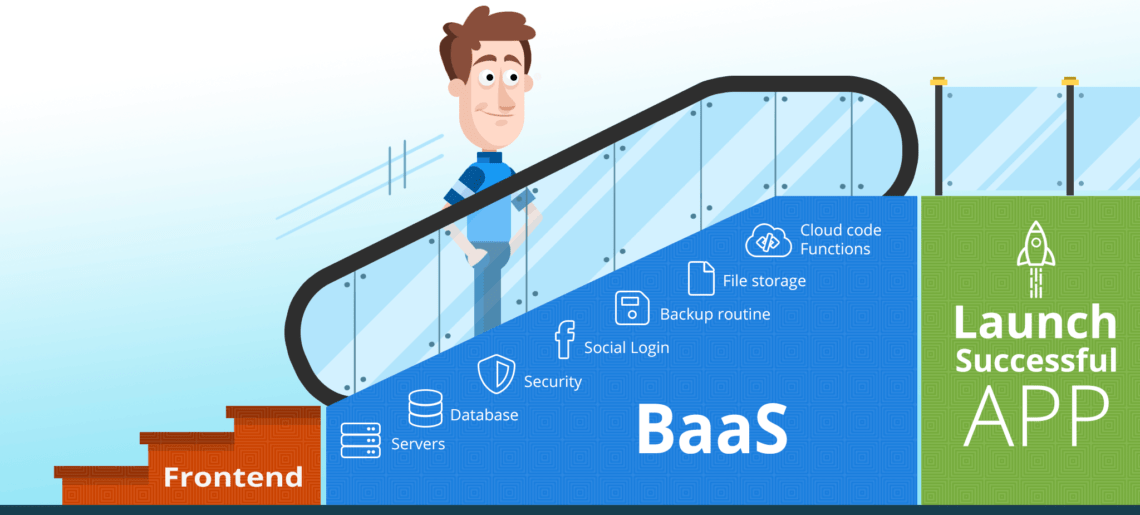

I recently spotted this post from Panagiotis Kriaris, who leads business development at Unzer: In the era of #APIs, #openbanking and #openfinance, banking has become a totally different game vs what it used to be calling for equally adapted business models. Let’s take a look at #businessbanking and at 4 potential #digital models for banks….

Financial people think digital will beat physical by 2030

I just picked up Deloitte’s report on blockchain where 76% of finance executives have voted that digital currencies may overtake fiat currencies in the next decade*. Most of us would just read that statement and go meh. Not me. That’s a phantasmagorical statement. People in finance think fiat currencies are dead? What? If true, we…

Who owns the mandate?

I was intrigued by a new report from the IMF entitled: The Impact of Fintech on Central Bank Governance (you can download it for free). I was particularly intrigued by its opening: Central bank governance is a concept composed of four constitutive and interrelated components: a central bank’s (i) mandate, comprising its objectives (the “why”),…

Chris Skinner Keynote, April 2025, Europe

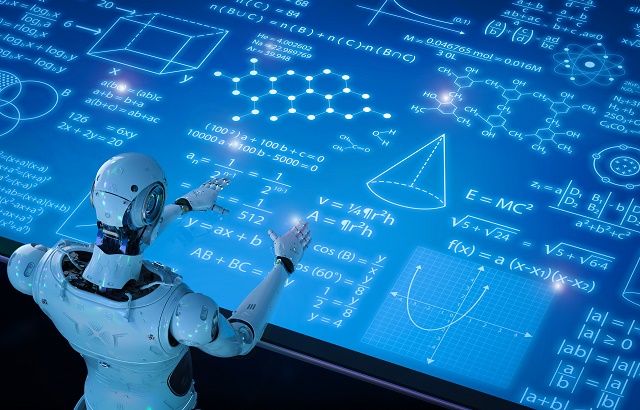

Intelligent Money: Our Future Is Where We Do Not Think About Money, As Our Money Thinks For Us

What is the future?

Learn more about Chris

The Past, Present And Future Of Banking, Finance And Technology

Fintech expert Chris Skinner: countries need digital transformation to remain competitive

Join me on Linkedin

Follow Me on X!

Hire Chris Skinner for dinners, workshops and more

Chris’s latest book

Chris Skinner’s ‘Intelligent Money’ Book Launch Event

Top 30 Regtech Blogs

Top 40 UK Fintech Blogs

Lifetime Achievement Award

Kids creating the future bank | TEDxAthens

Alex at the Financial Services

Gaping Void's Hugh MacLeod worked with the Finanser