Another day, another crash, another hack

I stumbled across a tweet about Nomad, a cross-chain bridge, that had just had almost $200 million of crypto assets hacked: The cross-chain token bridge Nomad was exploited, with attackers draining the protocol of virtually all of its funds. The total value of cryptocurrency lost to the attack totalled near $200 million. Nomad, like other…

What gender is your bank?

I’ve recently wondered about the movements to recognise gender-status in banking. For example, a headline appeared saying that the Halifax Bank, part of Lloyds Banking Group, was stupid for allowing someone to be recognised as she/her/hers. It didn’t go down well with some people … But it is a thing. Pronouns count, and banks are recognising…

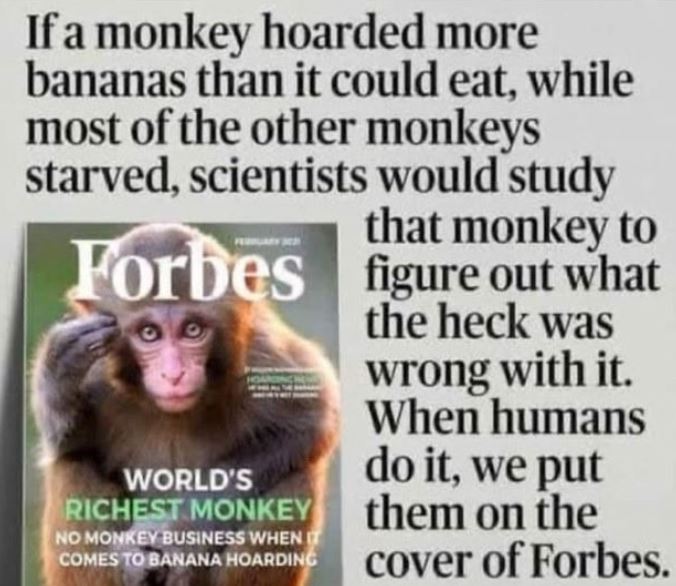

Why you should care about inequality, even if you don’t!

Gail Bradbrook, Co-Founder of Extinction Rebellion, joins her colleague Felix Barbour, to further address this challenge from an angry banker, who responded to her earlier blogs on this site. Maybe like HSBC’s Stuart Kirk, our angry banker is merely voicing what many of us silently think? The question then is, is he right? (Stuart Kirk…

The Finanser’s Week: 25th July 2022 – 31st July 2022

This week’s main blog headlines include … What’s your purpose? I find the world fascinating. Humans are amazing. We just launched the James Webb Telescope to see world’s formed billions of years ago and the Elizabeth Line. Both are engineering projects of immense challenge, and immense cost, as covered by many documentaries. Then I read…

What do you think of my Monet?

I blogged yesterday about the huge difficulty of proving I owned something, its history and provenance. This is actually something TV shows are made about and there is one on the BBC called Fake or Fortune, where our hosts and experts travel the world trying to prove if a rare item is real or fake….

What’s your purpose?

I find the world fascinating. Humans are amazing. We just launched the James Webb Telescope to see world’s formed billions of years ago and the Elizabeth Line. Both are engineering projects of immense challenge, and immense cost, as covered by many documentaries. Then I read that Chinese social media celebrates the assassination of Shinzo Abe,…

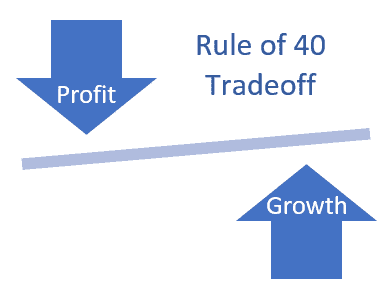

2022: hard times, massive opportunities

2022 is proving to be a challenging year and, if my experience proves true, is harder than anything since we have seen since the pandemic began. After two years of lockdown, funding is still freely available but harder to find, and valuations are way down on previous years. Nevertheless, according to new data released by…

Chris Skinner Keynote, April 2025, Europe

Intelligent Money: Our Future Is Where We Do Not Think About Money, As Our Money Thinks For Us

What is the future?

Learn more about Chris

The Past, Present And Future Of Banking, Finance And Technology

Fintech expert Chris Skinner: countries need digital transformation to remain competitive

Join me on Linkedin

Follow Me on X!

Hire Chris Skinner for dinners, workshops and more

Chris’s latest book

Chris Skinner’s ‘Intelligent Money’ Book Launch Event

Top 30 Regtech Blogs

Top 40 UK Fintech Blogs

Lifetime Achievement Award

Kids creating the future bank | TEDxAthens

Alex at the Financial Services

Gaping Void's Hugh MacLeod worked with the Finanser