A Single Customer View? Codswallop!

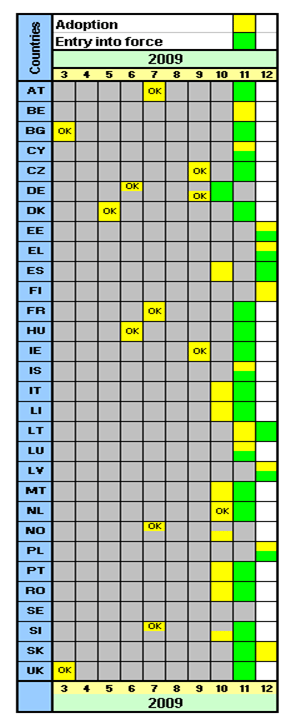

The UK Government recently ordered changes to the Financial Services Compensation Scheme (FSCS), as announced in the Banking Bill of 2009. The Bill resulted in a new regulation from the Financial Services Authority (FSA), Policy Statement 09/11 (Download FSA PS09/11). PS09/11 rules that, from 31 December 2010, all financial firms must provide a Single Customer…