Digital Bank

Banks are not stupid … just massively challenged

I talk a lot about the platform economy where the network joins us all together. In that economy, like life on Earth, there are many players. 1000’s of companies, millions of people and billions of capital. The question is: how to connect them? The answer is to be a connector in the connected economy, and…

How to digitally refresh to be fit for the future

I recently wrote a white paper for XBP Europe, which you can download (see later). It’s all about how to be fit for the future and digital transformation, my usual subjects. Just to give a taste of the paper, here’s a small extract: The obvious answer is to digitise the corporation. The harder question is:…

Real-time flexible finance is now

Ever since Trov, the real-time insurance firm, appeared on the scene, I’ve been wondering what else could real-time finance do. If you are not aware, Trōv allows you to insure a smartphone or laptop or anything else you value for hours, even minutes. The company no longer exists – it was acquired by Travelers Insurance…

What would Taylor Swift’s bank look like?

Trust and money and day-to-day life go hand-in-hand. It’s all about who you deal with, how and the outcomes. Recently, I’ve lost trust with Apple, my bank, my friend and my brother. That’s pretty sad, isn’t it? But who do I trust? David Bowie. David Bowie, RIP. Artist, music man, alien and hero. He was…

Do we have perfect market knowledge?

I’ve thought for years that we are moving towards perfect market knowledge, where demand and supply information becomes equal to all buyers and sellers. Now that we have OpenAI and Gemini, are we getting there? During the 1990s, I spent a lot of time discussing neural networking where we could pair stocks to buy and…

The growing deep fake scam crisis

“AI, powered by quantum computing, is going to put financial crime potentially on steroids.” It’s not my quote. It’s actually a comment made by David Duffy, CEO of Virgin Money (now Nationwide) after visiting Microsoft’s headquarters in Seattle. From my side, this is an area that’s been worrying me for a while, ever since the…

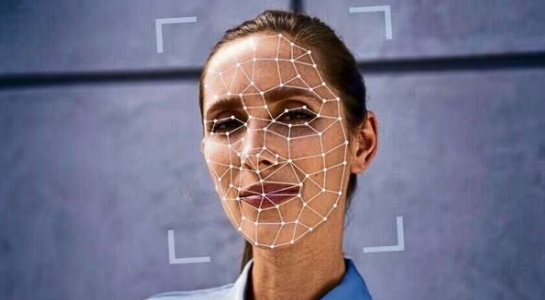

Big Brother is here and watching you

Talking about trust, the other side of the coin is what is the bank doing to protect privacy? Increasingly, due to regulatory concerns, banks are becoming government spies. They are watching our every move and reporting it. This recently cropped up on my personal radar when the bank became my interrogator and grilled me about…