How ya doing Pardna?

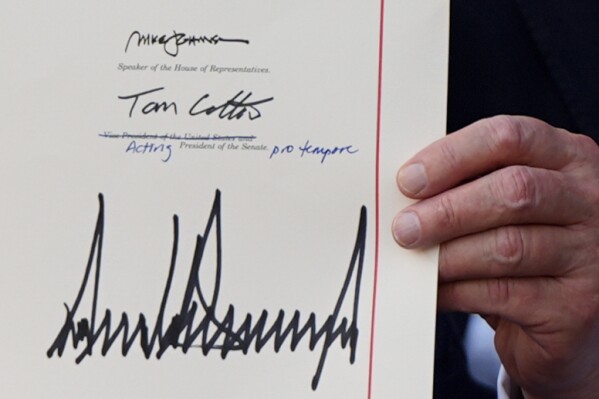

I am always fascinated about the way in which people see what is of value and why. The exchange of beads, crystals, diamonds and gold; the use of barter to exchange sheep for goats for weddings; the emergence of digital exchange for tokens; and, of course, the issuance of cash backed by governments that are…