Trainers, explainers and sustainers – mortgages by machines, part two

After my blog yesterday about mortgage by machines, I left out one key component: humans. You have to remember that machines don’t think, they only appear to think because we develop them that way. Sure, there may be sentient machines at some point in the future when we get to the great Singularity but, until…

Status quo is better than perturbatio

I have blogged often about change and how people avoid it (who moved my cheese?), but it cropped up again the other day when I was reading Harvard’s Rosabeth Moss Kanter* thoughts on business. She has six key principles for business: Show up. Speak up. Look up. Team up. Never give up. Lift others up. Many…

Stop doing digital and become intelligent

My presentations these days are focused upon the challenge of change. Every day, something is in the headlines to challenge your thinking from AI to quantum to digital currencies to digital identities. The only constant is change. Whenever I talk, I come back to the wrongly attributed quotation of Charles Darwin that it does not…

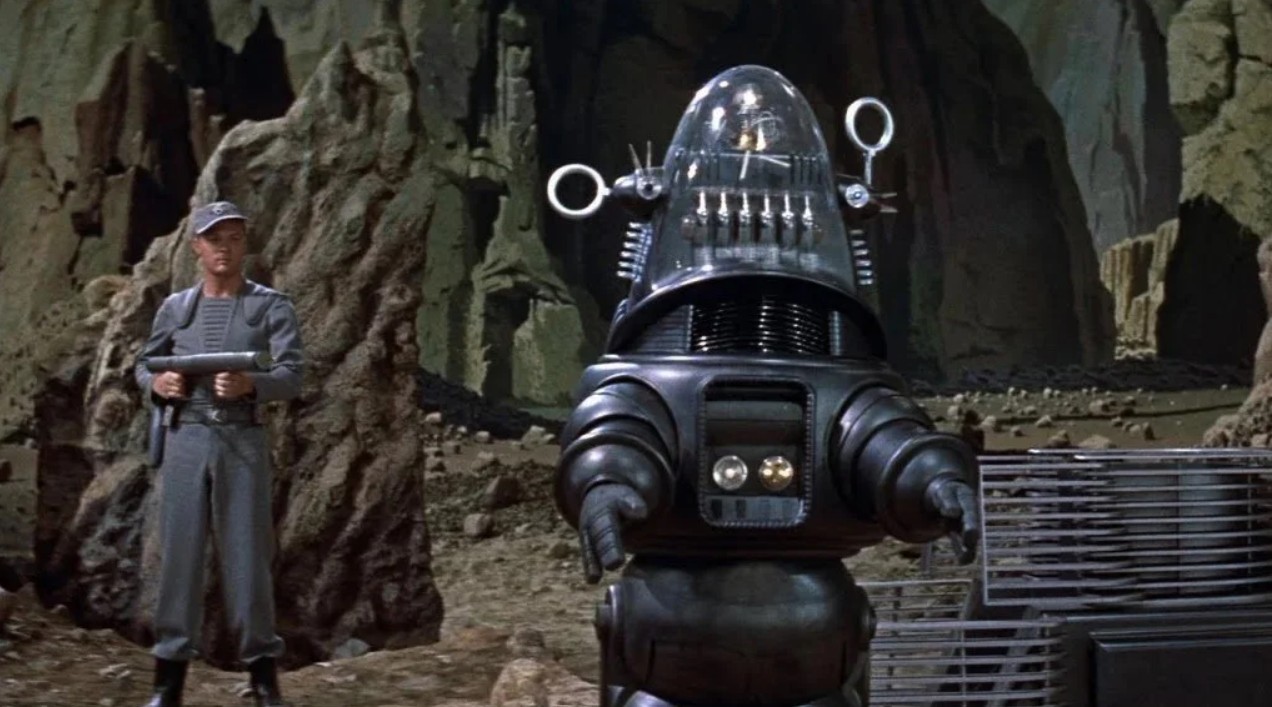

AI is not Robbie the Robot, says expert

I was really interested that Barclays Private Bank published an interview about AI the other day. Why? Because it’s the private bank and it’s from a bank. The interview is with Professor Michael Wooldridge, one of Oxford University’s leading AI academics with more than 450 research papers to his name. He knows his stuff. What…

The Finanser’s Week: 6th October – 12th October 2025

This week’s main discussions include … Is crypto the solution or the problem? Paying with crypto is traceable but favoured by fraudsters. Is it the solution or the problem? Fraudsters never know how their action impacts their victim, until confronted by the person they’ve defrauded. Is crypto the solution? After all, unlike fiat currencies, all…

Is crypto the solution or the problem?

Paying with crypto is traceable but favoured by fraudsters. Is it the solution or the problem? Fraudsters never know how their action impacts their victim, until confronted by the person they’ve defrauded. Is crypto the solution? After all, unlike fiat currencies, all blockchain-based transactions can be traced for history. So, is crypto the solution to…

The digital transformation disillusionment

My friend Paolo Sironi of the IBM Institute of Business Value has been touting his latest research: the 94% core banking problem. What’s it all that about? Well, it’s about how digital transformation or, as IBM calls it modernization, hasn’t delivered. In research conducted with a global survey of over 500 CIO’s and almost 200…