Turkey to be cashless by 2023

I spend a lot of time talking with my friends in Turkey, particularly since the big change in climate after the protests last year. Nevertheless, from a financial markets point of view, it’s a fascinating place. One of the first to be contactless and, more recently, one of the first to offer social retail banking….

The Top 1000 banks in the world

I’ve written a column for The Banker magazine for the last 15 years and, during that time, have collected their special July edition each year. Every July The Banker publishes their analysis of the Top 1000 banks in the world. In the 1990s, the top 10 were mainly Japanese; in the 2000s, American; and today, Chinese. This…

The way we bank is radically changing too

The British Bankers’ Association released their The Way We Bank annual report last Thursday. It was interesting. Here are the key highlights: Over the past five years customers’ activity on banking apps rocketed by 354%, with apps now an increasingly popular way to access current accounts rising from 21% of access in 2012 to 61%…

The Finanser’s Week: 25th June – 2nd July 2017

This week’s main blog headlines are … How we travel today will change massively tomorrow I was chatting with a friend about what he’s up to these days. He started talking earnestly about looking up his family ancestry. With the internet these days, you can quickly find your grandparents, great grandparents, great-great grandparents and even…

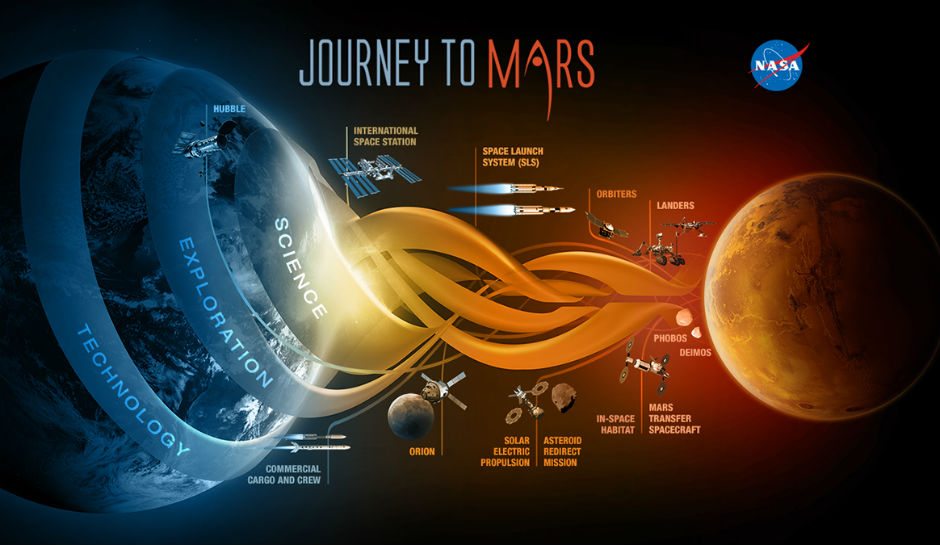

How we travel today will change massively tomorrow

I was chatting with a friend about what he’s up to these days. He started talking earnestly about looking up his family ancestry. With the internet these days, you can quickly find your grandparents, great grandparents, great-great grandparents and even your birth mother. He had traced some parts of his lineage to the 1600s in…

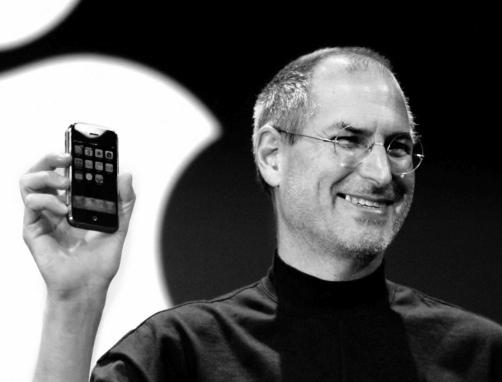

Did you realise it’s only 10 years since the iPhone was released?

It’s a decade since the iPhone launched. Steve Jobs unveiled the new phone on January 9th, 2007. The first iPhones were made available to the grubby hands of the public on June 29th, 2007, exactly ten years ago today. This was originally just for American consumers with the UK, France, and Germany following in November…

Is self-service all it’s cut out to be?

I find it amusing to think about this age of self-service, where we take it for granted that it’s cheaper, easier and more personalised to your own wishes if you book it yourself. And, for most of the time, that works well. Except when you mess things up, like booking non-refundable flights on the wrong…

It’s the ATM’s 50th birthday today!

It was exactly 50 years ago today that the world’s first ATM was unveiled at a Barclays branch in Enfield, London. As a tribute to the golden anniversary, Barclays has transformed the modern-day Enfield cash machine into gold. Today, more than half of UK adults use an ATM at least once a week. Barclays Bank…

Klarna is a great illustration of the financial marketplace

I was going to blog about something different, when I spotted this article in The Financial Times about Klarna gaining a banking license over the weekend (thanks to Pascal Bouvier). The commentary has two key sentences, which I’ve highlighted, that illustrate all the things I have been saying about Banking-as-a-Service and curated marketplaces brilliantly, namely: Banking becomes…