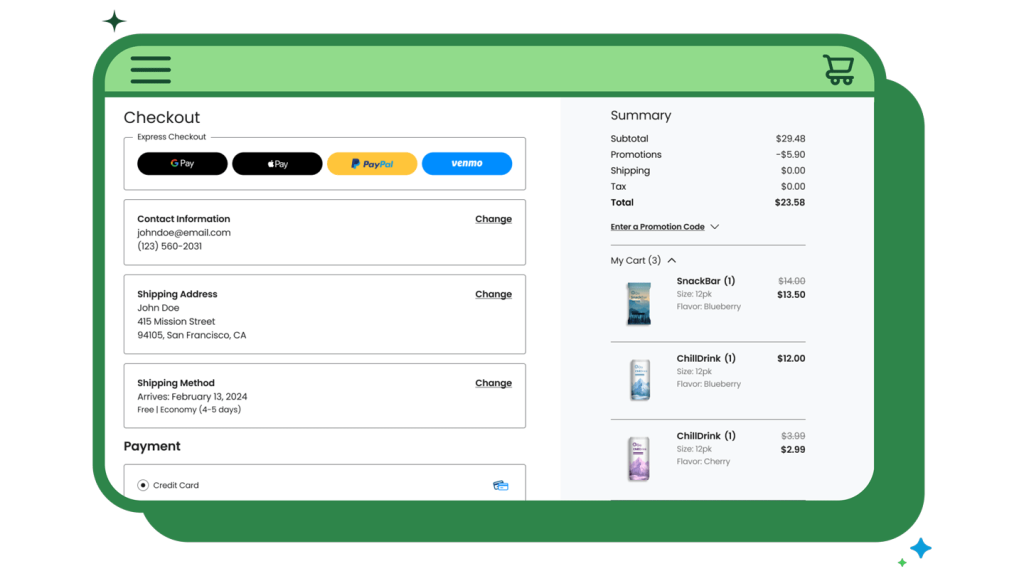

Digital Trust: How do you know you are you?

For many years now, we have been talking about digital identity. The core is how to prove you are you. You have to be identified, verified, authenticated and approved. You would think with so many layers of monitoring access that everyone online in the financial system could be trusted. So, how come there are criminals,…

IP risks in cryptocurrency trading and preventing cybercrimes

One of my friends just sent me an interesting article all about trust, fraud and cryptocurrency so, as a Christmas present, I wanted to share it with you. Here goes … With the digital revolution, crypto has become a global financial phenomenon. Blockchain technology has changed how we make transactions, interact with clients, and use…

The challenge is how to deliver freedom, security, control and privacy

A really interesting conversation popped up during a meeting with a fintech yesterday. The core of the discussion was around trust and identity – my favourite themes of the moment – and we got into a debate about the fact that most people want freedom and control of their lives. They want privacy and security…

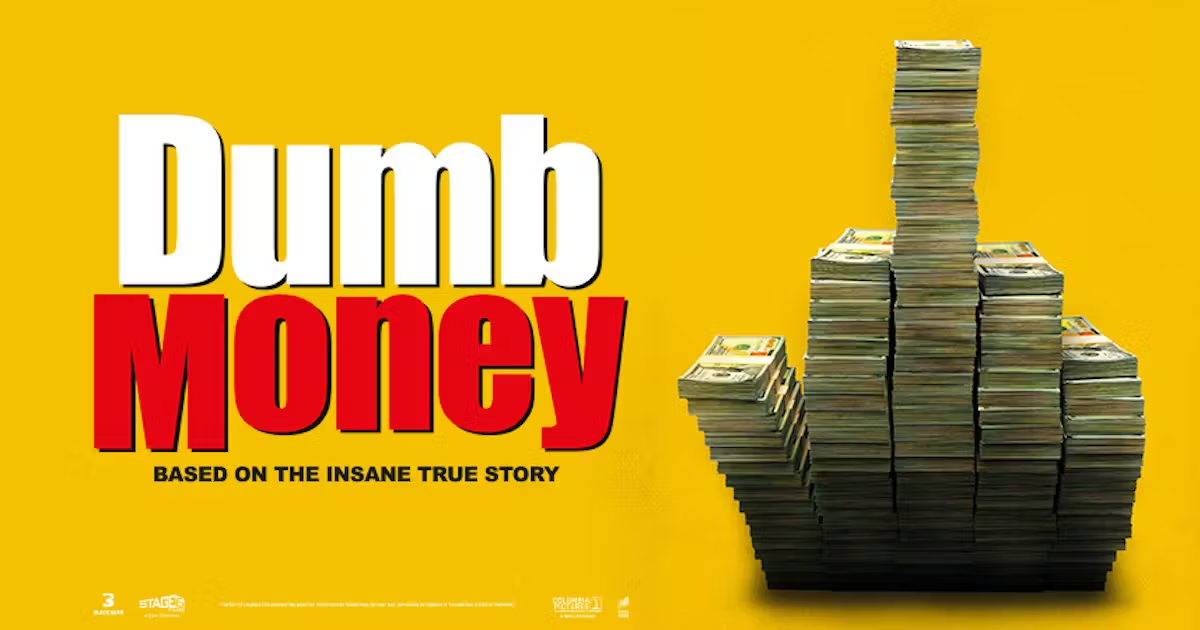

The forgotten story of Clarence Saunders vs Wall Street

I just watched Dumb Money, the true story of Gamestop where a wild band of small investors led by Roaring Kitty attacked the big Wall Street short sellers by banging the buck. The more small investors invested, via Robin Hood, the more short sellers lost as the stock rose instead of falling. It’s a good…

Banks make millions from the most vulnerable

As mentioned, I’m dealing with my mother’s financial affairs as she reaches end of life, and I’m finding it incredibly frustrating. The process is that there first needs to be a Power of Attorney in place. Luckily, she saw that coming and gave it to me. That’s a government portal which allows me to take…

Identity? Forget mobile … think eyeballs!

I just spotted a blog by Alan Stapelberg, who is Group Product Manager for Google Wallet. Here’s his opening para: “Imagine starting a vacation like this: You arrive at the airport and breeze through security by tapping your phone to a reader, scanning your boarding pass and ID. While waiting to board, you grab a…