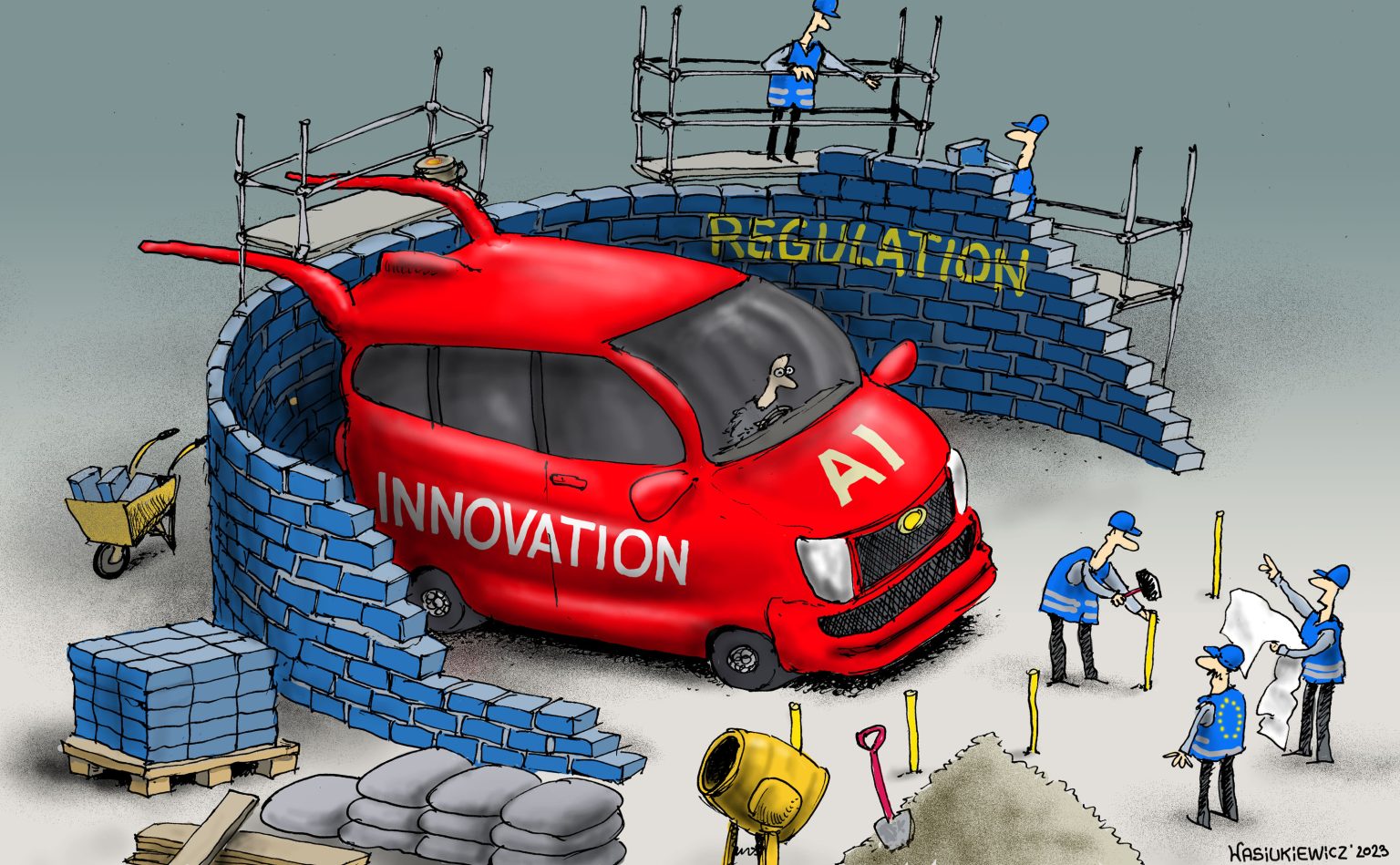

Looking for regulation and innovation in the same room

After recently attending conferences in Zurich and Paris, with most of the audience coming from the banking community, this week is Money2020 in Amsterdam and the discussions are very different. What’s the difference? Well, bankers debate regulations and fintechs discuss innovations. It constantly strikes me that, during the 2000s, I spent most of my time…