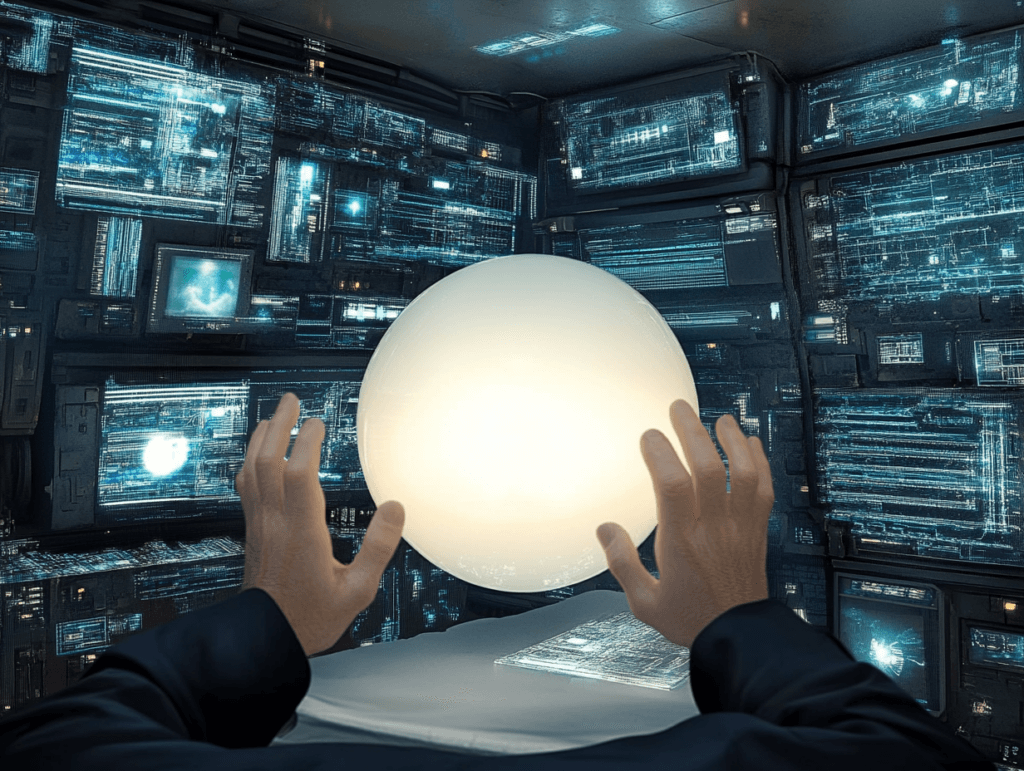

I love my robot, but does my robot love me?

Are we giving up on dating and instead putting all of our demands onto digital people who are programmed to behave and speak exactly how we want? A new survey of 2,000 British men and women between the ages of 18 and 45 produced by Equimundo, a US-based non-profit organisation, found that men have simply…