RegTech: Brother in Arms with FinTech

During recent months, I’ve enjoyed a real ding-dong of conversations between Europeans, Asians, Americans and Brits about FinTech and, to be more specific, RegTech. RegTech is a couple of years in catch-up with FinTech, and is all about how to use technologies to make regulations more efficient and effective. The claim is that the UK…

Banks are not dying

I was having a nice relaxing Sunday, when alerted to a tweetfest taking place between industry heavyweights Simon Taylor (an ex-banker) and Mariano Belinky (a banker). It all started with: Fintech didn’t disrupt banks but banks are slowly dying. Creating an ever growing opportunity for #fintech — Simon Taylor (@sytaylor) September 18, 2016 @sytaylor low…

An overdraft … is that someone who checks your first draft?

I got into a conference this week (for a change) where the presenter of a roboadvising wealth manager got into a bit of a Q&A scuffle with an audience member. Felix Niederer, founder and CEO of Zurich-based start-up True Wealth showed the stats for their customers. Most of them are over 30, and the real…

The Banking Bazaar and the Bizarre Banker

I’ve spent a lot of this week talking about marketplaces. We have a growing number of financial marketplaces appearing. Lending marketplaces, credit marketplaces, payments marketplaces and more. A marketplace is the bazaar. Market stall holders gather to meet with prospective clients, and the digital version of the marketplace is the focal point for many FinTech…

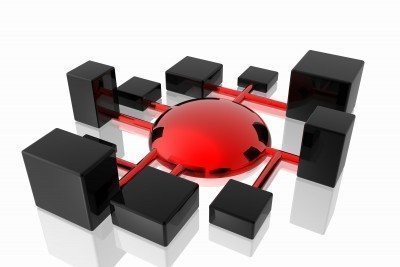

The future CIO is not a CIO

As mentioned last week, the CIO’s role is changing from running an empire of maintenance engineers to organising a distributed development organisation. The change in the role is one from a hierarchical control structure, where everything is proprietary and internal, to a flattened organisation that is open and broad. Much of the developments will come…

The developer-driven bank

Building on yesterday’s blog (Do bank’s need a CIO?) , the key misunderstanding is the role. Most banks thing the CIO is there to run the technology. They’re not. That’s what they used to do. That’s not the job for the future. First and foremost, the person leading technology developments in any incumbent bank of…

India’s billion digital identities

I’ve blogged a lot about digital identities, but failed to cover an in-depth review of the largest identity program in the world: Aadhaar. It’s been very remiss of me, but I’ve been waiting for the right moment and now seems to be that moment. Aadhaar is well known for those in the identity field, but…