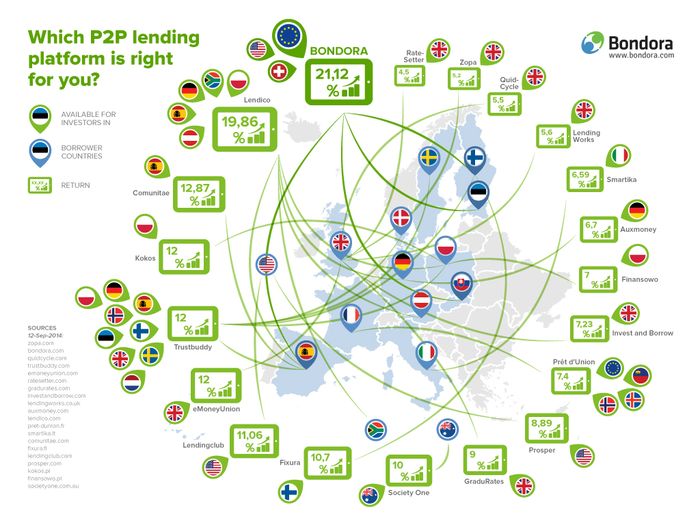

Banks face more change in next 10 years than in the last 200

Sticking with the future predictions, I usually quote the great American baseball player Yogi Berra: “it’s tough to make predictions, especially about the future”. He had quite a few comments of that ilk: “the future isn’t what it used to be”, and it is certainly true. It is particularly true when we look at the…