The true horrors of bank bureaucracy

Every now and again, a newspaper produces a piece that is amusing, interesting and enlightening about banking. The Daily Telegraph did just this the other day and I liked it so much that I’ve stolen it to reproduce here. Enjoy … The true horrors of British bank bureaucracy Telegraph readers showcase the true horrors of…

How much energy should a monetary system consume?

I caused quite a debate on twitter over the weekend when sharing the supposed fact that one bitcoin transaction uses the same amount of energy as a US household uses over a month. ONE Bitcoin transaction uses the same amount of energy as a US household uses over a monthhttps://t.co/1z5HgzRLRo — Chris Skinner (@Chris_Skinner) June…

The EU Digitalisation Strategy for the Financial Services Sector is put to the test

For twenty years, I’ve been very close to the harmonisation strategies in Europe for a single financial centre structure. From UCITS to MiFID to SEPA and the PSD, it’s all very close to my heart … as it is with David Doyle, a good friend and an EU Financial Services Regulatory Expert (speaking at the…

This week’s FU (Fintech Uncut)

One of the world’s biggest VC firms announced its opening its first office outside the USA and expanding to the UK. WHY?? is the question on the team’s minds! Guest Judge Conny Dorrestijn brought some much needed “RI” (REAL INTELLIGENCE) to the show, adding great insights and provocative points to the conversation which included news…

The arguments for and against digital money

FedNow is launching in July, as mentioned in March. Interestingly, there has been a huge debate about this as Robert F. Kennedy (RFK) Junior tweeted: The Fed just announced it will introduce its “FedNow” Central Bank Digital Currency (CBDC) in July. CBDCs grease the slippery slope to financial slavery and political tyranny. While cash transactions are…

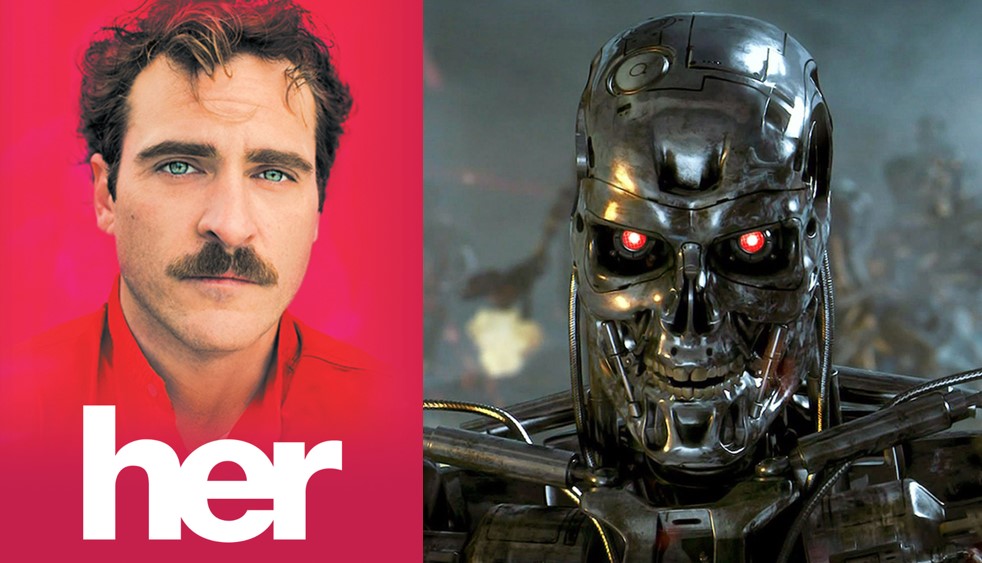

The emergence of BankGPT is something

My friend Dave Birch posted an insightful piece on Forbes the other day. I liked it so much that I asked him if I could share it here and he kindly said yes! Enjoy … The Impact Of ChatGPT And Open Banking Cannot Be Underestimated by Dave Birch, Author, advisor and global commentator on digital financial services….