Cyberwars: a far bigger threat than hacktivists

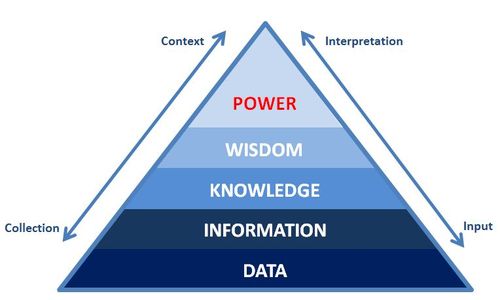

Whilst consumers are electing the next major political leader via crowdsourced populism, governments and companies begin developing cyberarms. This cyberwarfare is already rife, with a host of malware targeting middle eastern nations (see end of blog entry). What is obvious from these developments is that cyberattacks are the new form of warfare that evades direct…