Tom Blomfield on what purpose-driven banking means

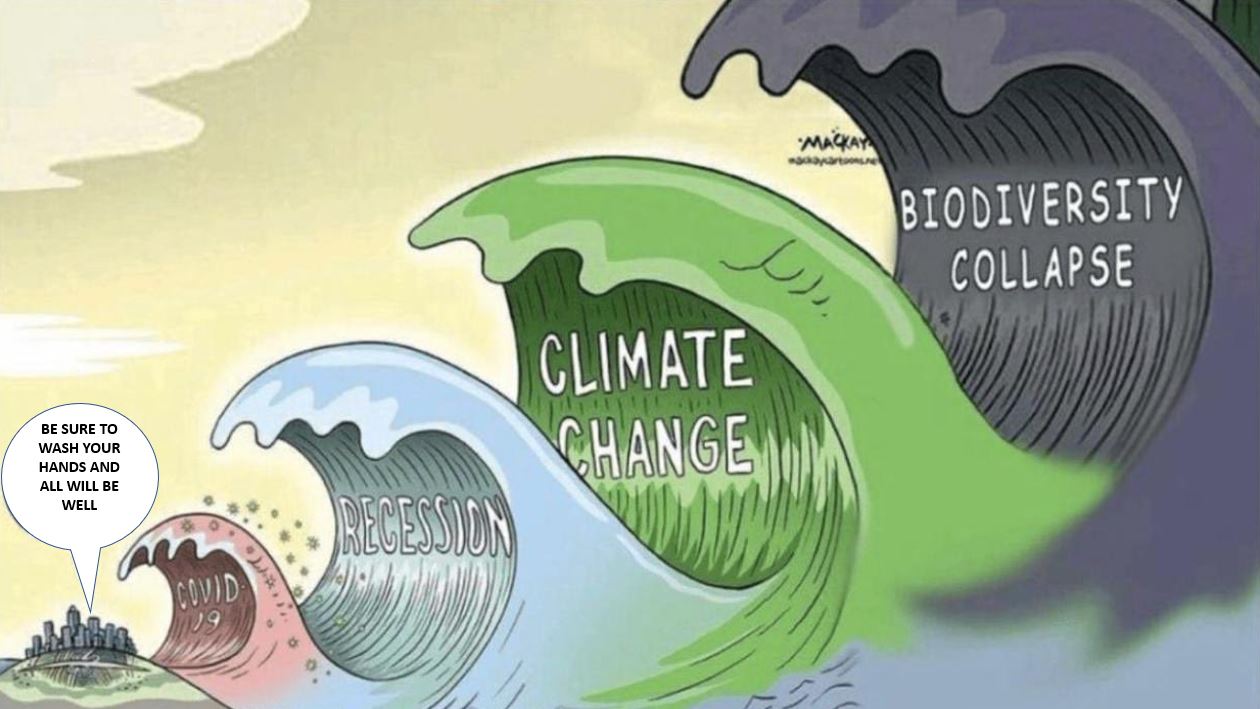

I’m working on a new book project. You might have spotted the themes in my recent blog entries but, if not, it’s all about purpose. The tagline is: if you don’t stand for something, you fall down, and is focused upon stakeholder capitalism. ESG, CSR and all that stuff and more. So, I’ve been watching for leaders who talk about…